Exhibit 99.2

Maestro Health, LLC.

and Subsidiaries

Consolidated Financial Statements

Nine Months Ended

September 30, 2022

(Unaudited)

Maestro Health, LLC. and Subsidiaries

Table of Contents

September 30, 2022

Page(s)

Independent Auditors’ Review Report 1

Consolidated Balance Sheets 2

Consolidated Statements of Operations 4

Consolidated Statement of Members’ Deficit 5

Consolidated Statements of Cash Flows 6

Notes to the Consolidated Financial Statements 7-16

Independent Auditors’ Review Report

To the Board of Directors and Members of Maestro Health, LLC

Results of Review of Interim Financial Information

We have reviewed the accompanying consolidated financial statements of Maestro Health, LLC and subsidiaries (the “Company”) which comprise the balance sheet as of September 30, 2022, and the related consolidated statements of operations, members’ deficit, and cash flows for the nine-month period September 30, 2022 and the related notes (collectively referred to as the “interim financial information”).

Based on our review, we are not aware of any material modifications that should be made to the interim financial information referred to above for it to be in accordance with accounting principles generally accepted in the United States of America.

Basis for Review Results

We conducted our review in accordance with auditing standards generally accepted in the United States of America applicable to reviews of interim financial information. A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. A review of interim financial information is substantially less in scope than an audit conducted in accordance with generally accepted auditing standards, the objective of which is an expression of an opinion regarding the financial information as a whole, and accordingly, we do not express such an opinion. We are required to be independent of the Company and to meet our other ethical responsibilities in accordance with the relative ethical requirements relating to our review. We believe that the results of the review procedures provide a reasonable basis for our conclusion.

Responsibilities of Management for the Interim Financial Information

Management is responsible for the preparation and fair presentation of the interim financial information in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of interim financial information that is free from material misstatement, whether due to fraud or error.

Report on Consolidated Balance Sheet as of December 31, 2021

We have previously audited, in accordance with auditing standards generally accepted in the United States of America, the consolidated balance sheet of the Company as of December 31, 2021, and the related consolidated statements of operations, members’ (deficit), and cash flows for the year then ended (not presented herein); and in our report dated May 20, 2022, we expressed an unmodified audit opinion on those audited consolidated financial statements. In our opinion, the accompanying condensed consolidated balance sheet of the Company as of December 31, 2021, is consistent, in all material respects, with the audited consolidated financial statements from which it has been derived.

/s/ Mazars USA LLP

Fort Washington, PA

January 6, 2023

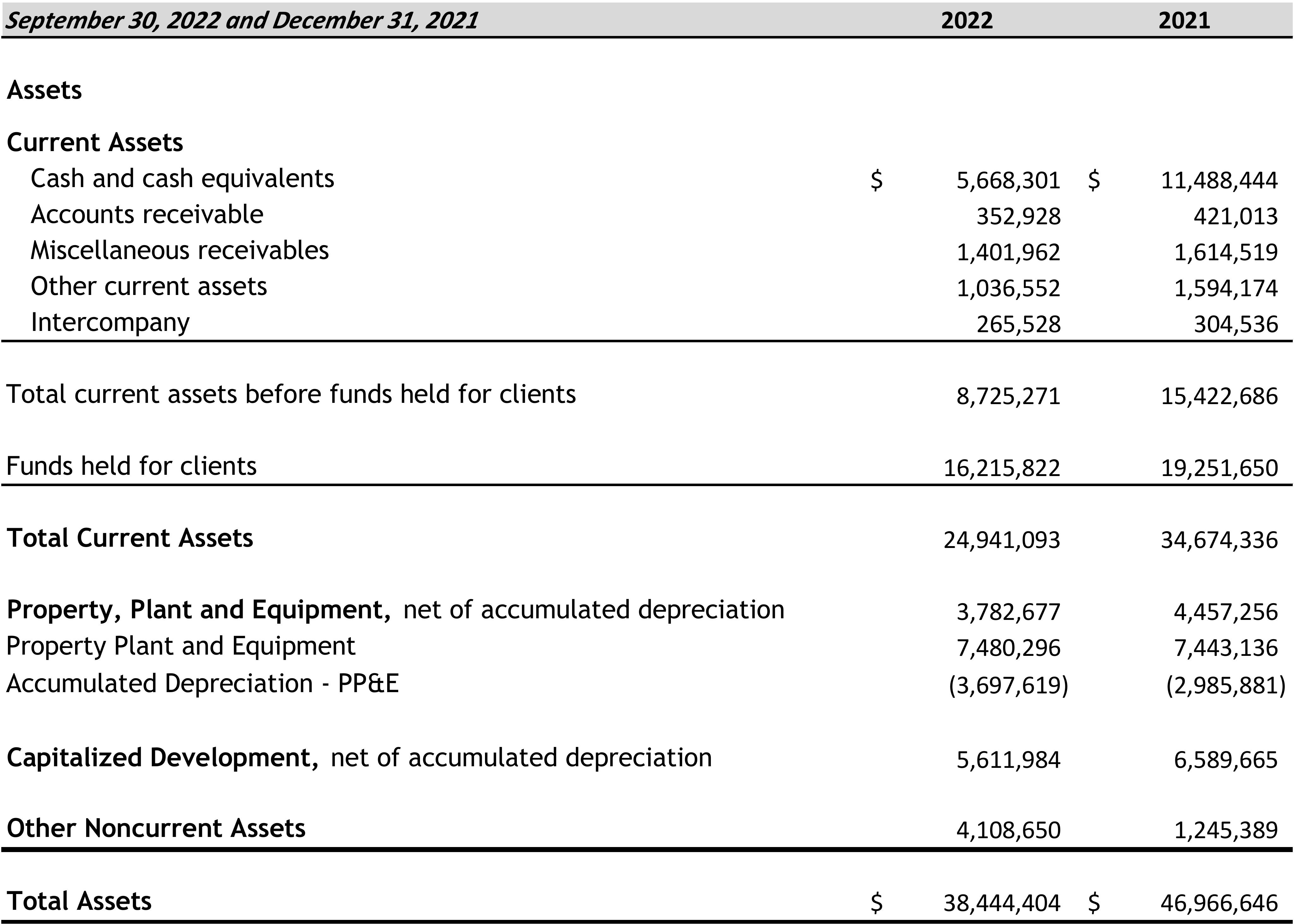

Maestro Health, LLC. and Subsidiaries

Consolidated Balance Sheets

September 30, 2022 (Unaudited) and December 31, 2021

The accompanying notes are an integral part of these consolidated financial statements.

2

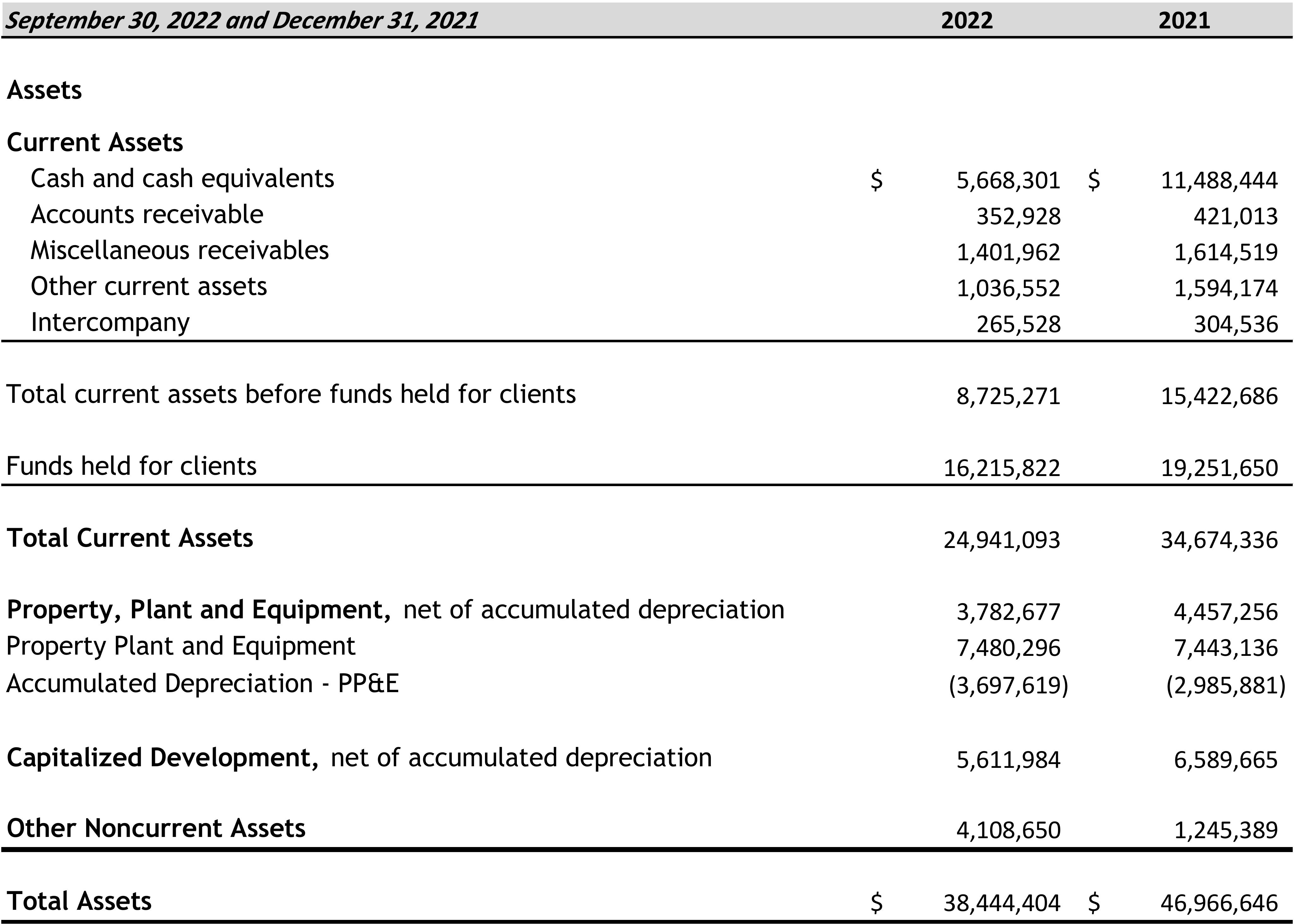

Maestro Health, LLC. and Subsidiaries

Consolidated Balance Sheets (Cont’d)

September 30, 2022 (Unaudited) and December 31, 2021

The accompanying notes are an integral part of these consolidated financial statements.

3

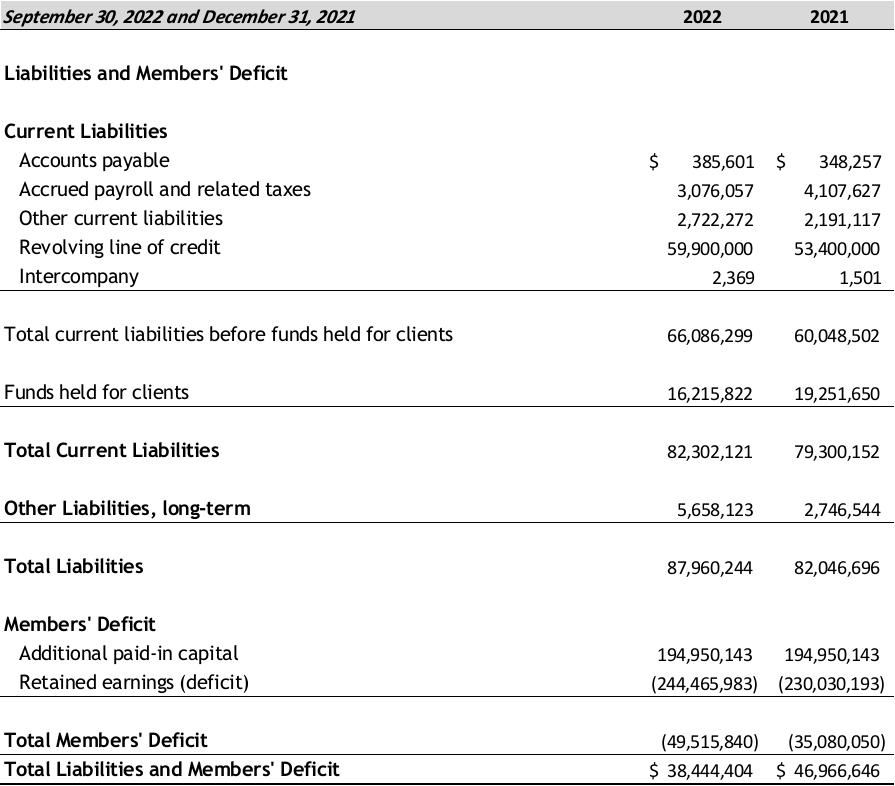

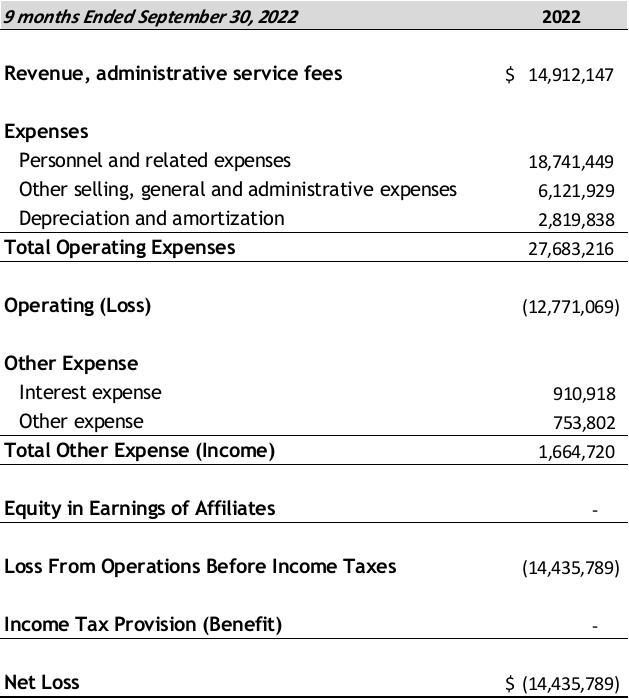

Maestro Health, LLC. and Subsidiaries

Consolidated Statements of Operations

Nine Months Ended September 30, 20222 (Unaudited)

The accompanying notes are an integral part of these consolidated financial statements.

4

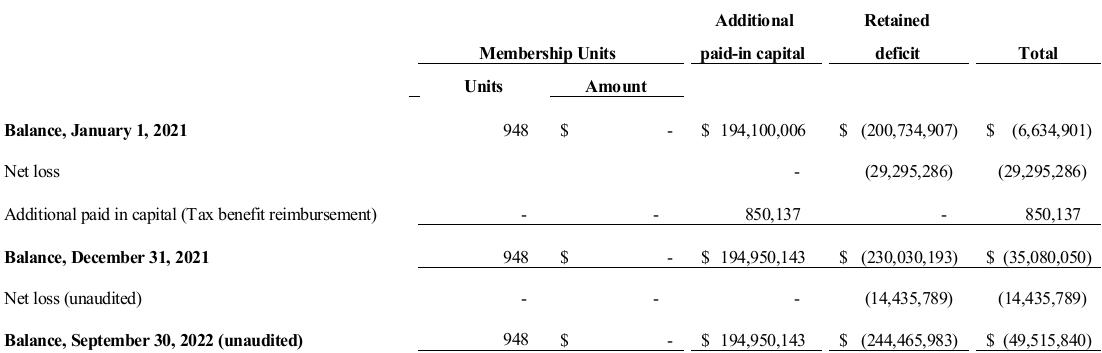

Maestro Health, LLC. and Subsidiaries

Consolidated Statement of Members’ Deficit

Nine Months Ended September 30, 2022 (Unaudited), and Year Ended September 30, 2022

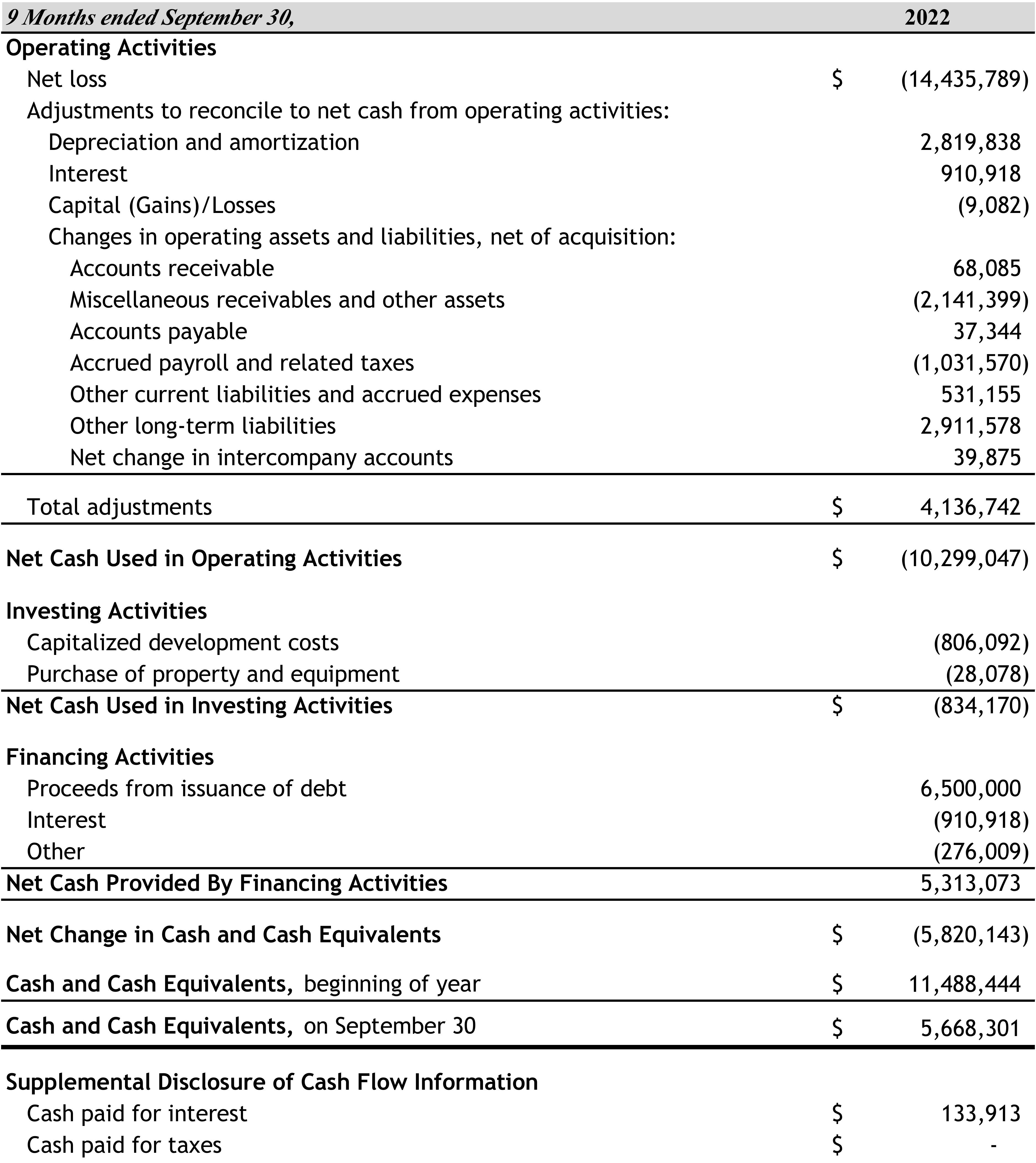

Consolidated Statements of Cash Flows

Nine Months Ended September 30, 2022 (Unaudited)

The accompanying notes are an integral part of these consolidated financial statements.

5

Maestro Health, LLC. and Subsidiaries

The accompanying notes are an integral part of these consolidated financial statements.

6

Maestro Health, LLC. and Subsidiaries

Notes to the Consolidated Financial Statements

Nine Months Ended September 30, 2022 (Unaudited)

Organization, Nature of Operations, and Management Plans

Maestro Health, LLC and Subsidiaries (the “Company”) is a Self-Funded Health Plan service provider which delivers a complete, all-in employee health and benefits solution to brokers, carriers, and employers.

Maestro Health, LLC is a Delaware domiciled limited liability company owned 100% by the AXA Group. It was formerly known as Maestro Health Inc., a Delaware domiciled corporation, which was organized on May 2, 2013. Maestro Health, Inc. converted to Maestro Health, LLC effective as of December 17, 2020. The Company’s services help employers control all aspects of the complex employee health and benefits system. The Company owns and operates self-funded insurance administration, benefits administration, enrollment, ACA compliance, consumer directed health care account administration, medical management, and consolidated billing solution applications, unifying them on a single, comprehensive mobile and web platform. In 2021, the Company added an Out of Network Repricing Solution and an Rx Patient Assistance Program to its service offerings. The Company provides services to clients throughout the United States from offices in Chicago, Illinois (headquarters); Charlotte, North Carolina; Southfield, Michigan; and Bethesda, Maryland.

The Company has experienced operating losses and negative cash flows from operations since inception and has been primarily funded with equity contributions and proceeds under credit facilities. At September 30, 2022, the Company has total members’ deficit of ($49,515,840) and a retained deficit of ($244,465,983), largely driven by the impairment of intangible assets in 2020 and 2019.

On August 4, 2022, it was announced that AXA S.A. agreed to sell all of its holdings in the Company to Marpai, Inc. (“Marpai”) a Self-Funded Health Plan service provider which delivers employee health and benefits solutions to brokers, carriers, and employers. It is expected that the synergies between the two organizations will result in profitable growth.

Marpai is traded on the NASDAQ under the symbol “MRAI”.

Following the acquisition, which was completed on October 31, 2022 the Company became a wholly owned subsidiary of Marpai and Marpai became the holder of the $59.9 million consolidated loan (see Note 6). As part of the agreement, AXA agreed to fund the operations of Maestro through the end of 2023 by guaranteeing a cash balance upon closing of $15,700,000. Of which, an amount of $14 million cash transfer was received on October 27, 2022.

It is expected that following the acquisition, the operations of the Company and Marpai will be consolidated so that they will operate as one single company, and the Company as presently constituted will no longer be an independent stand-alone business entity.

Consolidation

The consolidated financial statements include the financial results of Maestro Health, Inc. and its wholly owned subsidiaries. The wholly owned subsidiaries are Integra Employer Health, LLC, Context Benefit Advisors, LLC, Workable Solutions, LLC, and Group Associates, Inc. Intercompany balances and transactions have been eliminated in consolidation. A formerly wholly owned subsidiary, IntegraHealth Management, LLC, was dissolved as of September 26, 2019. Colton Groome Benefit Advisors, LLC was renamed Context Benefit Advisors, LLC as of October 16, 2019.

The accompanying notes are an integral part of these consolidated financial statements.

7

Maestro Health, LLC. and Subsidiaries

Use of Estimates

The preparation of the consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Estimates and assumptions are used for, but not limited to, establishing the allowance for doubtful accounts, purchase price allocations, depreciation and amortization useful lives, capitalization of development costs, asset impairment evaluations, deferred tax assets and liabilities, rebate receivables, stock-based compensation, and other contingencies. Actual results could differ from those estimates.

Cash and Cash Equivalents

Cash and cash equivalents are maintained at financial institutions, and, at times, balances may exceed federally insured limits. The Company has never experienced losses related to these balances.

Accounts Receivable

The Company evaluates historical information and current economic conditions, as well as individual account histories when establishing the allowance for doubtful accounts. The policy for reserving for uncollectible accounts is to do so once accounts become over 180 days outstanding or the customer has filed for bankruptcy. As of September 30, 2022 and December 31, 2021, the Company recorded $50,276 and $6,375 in the allowance for doubtful accounts, respectively.

Miscellaneous Receivables

The Company accounts for other miscellaneous receivables for unsettled transactions and other monetary obligations owed by other debtors. The miscellaneous receivables classified in current assets are related to client activities due to the Company from other debtors for referral, commission, and rebate income.

Funds Held for Clients and Custodial Receivables (Payables)

The Company holds funds for clients in the form of custodial cash. These amounts are held to pay claims, stop loss premiums, and medical, dental, and voluntary insurance premiums on behalf of clients and participants. This custodial cash is shown on the Company’s consolidated balance sheets as part of funds held for clients and custodial receivables (payables) as an asset and a corresponding liability.

In its capacity as a third-party administrator, the Company bills and collects insurance premiums from benefits administration clients on behalf of insurance carriers and collects payments from self-funded clients for the purpose of paying health insurance claims of their employees. Billings and payments called are reflected as receivables with a corresponding liability recorded as part of funds held for clients and custodial receivables (payables). The Company will not pay the liability until the receivable has been fully funded.

Property and Equipment

Property and equipment, other than property and equipment acquired in acquisitions as described in Note 2, are recorded at cost less accumulated depreciation and amortization. Depreciation and amortization are computed using a straight-line method applied to useful lives as follows:

Furniture and equipment |

7 years |

Marketing equipment |

7 years |

Computer equipment |

5 years |

Telephone systems |

5 years |

Leasehold improvements |

3 years or remaining life of lease |

Software |

3 years |

The accompanying notes are an integral part of these consolidated financial statements.

8

Maestro Health, LLC. and Subsidiaries

Repairs and maintenance are expensed when incurred and expenditures for improvements are capitalized. Upon sale or retirement, the related cost and accumulated depreciation are removed from the respective accounts and any resulting gain or loss is included in operations.

Software Development Costs

Software development costs are accounted for in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Subtopic 985-20 if the software is to be sold, leased or otherwise marketed, or by FASB ASC Subtopic 350-40 if the software is for internal use. For internal use software, capitalization of software development costs begins during the application development stage and concludes when the product is substantially complete and ready for its intended use. The ongoing assessment of the recoverability of these costs requires considerable judgment by management with respect to certain external factors, including, but not limited to, anticipated future product revenue and related cash flows, estimated economic product lives, and changes in software and hardware technology. The capitalized software development cost at September 30, 2022 and December 31, 2021 was $12,300,719 and $11,494,627 respectively. The costs capitalized in 2021 and 2022 relate to various ongoing development projects related to the Company’s mobile and web platform. Once software projects become available for general release, the Company begins to amortize the costs over the related project’s estimated economic useful life to Depreciation and Amortization expense. Accumulated amortization was $6,688,735 and $4,904,962 as of September 30, 2022 and December 31, 2021, respectively.

Long-Lived Assets

The Company periodically reviews the carrying value of long-lived assets for recoverability or whenever events or changes in circumstances indicate that such amounts have been impaired. The Company’s method for measuring impairment of long-lived assets is an undiscounted cash flow basis. Impairment indicators include, among other conditions, cash flow deficits, historic or anticipated decline in revenue or operating profit, and a material decrease in the fair value of some or all of the assets. If such impairment exists, the carrying value of the asset is reduced to its estimated fair value based on discounted cash flows. As of December 31, 2020, management chose to impair its long-lived assets in full which amounts to $7,756,713. After this impairment, the Company does not have intangible assets.

Business Combinations

When the Company acquires businesses or business assets in a business combination, the total consideration paid is allocated to the fair value of the tangible assets, liabilities, and identifiable intangible assets acquired. Any residual purchase consideration is recorded as goodwill. The allocation of the purchase price requires management to make significant estimates in determining the fair values of assets acquired, and liabilities assumed. These estimates are based on the application of valuation models using historical experience and information from independent valuation consultants. These estimates can include, but are not limited to, the cash flows that an asset is expected to generate in the future, the appropriate weighted-average cost of capital, the cost savings expected to be derived from acquiring an asset and estimated earn-out liabilities based on future results. These estimates are inherently uncertain and unpredictable. In addition, unanticipated events and circumstances may occur which may affect the accuracy or validity of these estimates. Acquisition-related costs are expensed as incurred. Refer to Note 2 for further information.

Goodwill and Indefinite Life Intangible Assets

Goodwill represents the excess of the purchase price over the fair value of net assets acquired in business combinations. The Company elected to adopt Accounting Standards Update (“ASU”) 2014-02, “Intangibles – Goodwill and Other (Topic 350),” an alternative to the previously issued standard ASU 2011-08, which allows private companies to amortize goodwill. Upon adoption effective January 1, 2015, the Company began to amortize goodwill over ten years. Under the private company guidance, the Company has also elected to test goodwill for impairment at the consolidated level. Prior to the adoption of ASU 2014-02, the Company tested goodwill for impairment at the reporting unit level. Under ASU 2014-02, goodwill is tested for impairment if a triggering event occurs, or circumstances change that indicate that the fair value of the entity may be below its carrying amount. If an entity determines that there are no triggering events, then further testing is unnecessary. Upon the occurrence of

The accompanying notes are an integral part of these consolidated financial statements.

9

Maestro Health, LLC. and Subsidiaries

a triggering event, an entity may assess qualitative factors to determine whether it is more likely than not (i.e., a likelihood of more than 50%) that the fair value of the entity is less than its carrying amount, including goodwill. An entity may bypass the qualitative assessment and proceed directly to a quantitative assessment. If, after assessing the totality of events or circumstances, it is determined that it is not more likely than not that the fair value of the entity is less than its carrying amount, further testing is unnecessary. If, after assessing the totality of events or circumstances, an entity determines that it is more likely than not that the fair value of the entity is less than its carrying amount or if the entity elected to bypass the qualitative assessment, the fair value of the entity should be determined. The fair value of the entity is then compared with its carrying amount, including goodwill. A goodwill impairment loss is recognized if the carrying amount of the entity exceeds its fair value and is measured as the amount by which the carrying amount of the entity including goodwill exceeds its fair value. After a goodwill impairment loss is recognized, the adjusted carrying amount of goodwill is its new accounting basis, which is amortized over the remaining useful life of goodwill. In 2019, the management decided to impair fully the goodwill, discussed further in Note 3. As of September 30, 2022 and December 31, 2021, goodwill remains zero.

Definite Life Intangible Assets

Client contracts and lists, developed technology, non-compete agreements, and certain other trade names were recorded at their estimated fair value at the date of each respective acquisition and are amortized over their estimated useful lives generally ranging from one to 15 years using the straight-line method. The Company evaluates definite life intangible assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset might not be recoverable. An impairment loss is recognized when estimated undiscounted future cash flows expected to result from the use of the asset are less than its’ carrying amount. At March 1, 2018, all intangible assets were marked to net book value and revalued at fair market value as a result of the AXA Acquisition. As of December 31, 2020, there were impairment charges fully impairing the remaining definite lived intangible assets, which is further discussed in Note 3. As of September 30, 2022 and December 31, 2021, the net book value of the intangible assets remains zero.

Employee Benefit Plan

The Company has established a voluntary investment plan that covers all eligible employees. Employees may elect to contribute up to 100% of gross salary to this plan, and the Company matches the employee contribution up to 2% of gross salary, up to the 2022 IRS limit of $20,500. Non-elective employer contributions vest immediately at the rate of 100%. Contributions made to or on the behalf of employees under these plans were $175,807 as of September 30, 2022. Contributions made by the employees amounted to $726,862 at September 30, 2022.

Revenue Recognition

The Company recognizes revenue in accordance with ASC 606, a comprehensive revenue recognition standard for virtually all industries under U.S. GAAP. The revenue standard’s core principle is built on the contract between a vendor and a client for the provision of goods and services. It attempts to depict the exchange of rights and obligations between the parties in the pattern of revenue recognition based on the consideration to which the vendor is entitled.

The Company’s policy is to begin to record revenue only when the following criteria are met:

The accompanying notes are an integral part of these consolidated financial statements.

10

Maestro Health, LLC. and Subsidiaries

The Company’s revenues are largely attributable to administrative service fees collected from employers on a per member basis, medical management fees charged on an hourly basis, as well as commission income on the repricing of out of network claims, the Rx savings achieved, and insurance products sold. In accordance with the above-outlined policy and with the various administrative service agreements with clients, fees associated with services are recognized in the period such services are rendered and earned.

The Company also has certain revenue associated with client agreements where services are provided over a contract period that spans multiple months. Revenue for these arrangements is recognized under the proportional performance method on a ratable basis over the period of the entire arrangement.

Income Taxes

The Company follows the provisions of ASC 740-10-25, “Accounting for Uncertainty in Income Taxes,” which seeks to reduce the diversity in practice associated with certain aspects of the recognition and measurement related to accounting for income taxes. Under ASC 740-10-25, an organization must recognize the tax benefit associated with tax positions taken for tax return purposes when it is more likely than not that the position will be sustained. The Company recognizes any corresponding interest and penalties associated with its income tax positions in income tax expense.

Paid Time Off (PTO)

The Company accrues for employee vacation when the rights vest and accumulate and such amounts can be reasonably estimated.

Fair Value of Financial Instruments

The carrying values of financial instruments such as cash and cash equivalents, accounts receivable, accounts payable, and accrued expenses are reasonable estimates of their fair value because of the short maturity of these items. The Company believes that the current carrying amount of its notes payable approximates fair value because the interest rates on these instruments are subject to change with, or approximate, market interest rates.

Concentrations

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash and accounts receivable.

The Company grants credit to clients of various sizes throughout the United States. For the period ended September 30, 2022, one client made up approximately 19% of total revenues. As of September 30, 2022 and December 31, 2021, one client made up approximately 31% and 16%, respectively, of accounts receivable. The Company does not have any significant suppliers.

Trust Assets and Liabilities

In its capacity as a third-party administrator, the Company bills and collects insurance premiums from benefits administration clients on behalf of insurance carriers and collects payments from self-funded clients for the purpose of paying health insurance claims of their employees. Billings and payments called are reflected as receivables with a corresponding liability recorded as premiums payable or as claims payable. The Company will not pay the liability until the receivable has been fully funded.

The accompanying notes are an integral part of these consolidated financial statements.

11

Maestro Health, LLC. and Subsidiaries

Reclassifications

Certain prior year amounts have been reclassified to conform to the current year presentation.

Recently Issued Accounting Standards

In February 2016, the FASB issued ASU 2016-02, “Leases,” which establishes a comprehensive new lease accounting model. ASU 2016-02 clarifies the definition of a lease and causes lessees to recognize leases on the balance sheets as a lease liability with a corresponding right-of-use asset for leases with a lease term of more than one year. ASU 2016-02 is effective for financial statements issued for fiscal years beginning after December 15, 2021 and interim periods within those fiscal years, with early adoption permitted. ASU 2016-02 requires a modified retrospective transition for capital or operating leases existing at or entered into after the beginning of the earliest comparative period presented in the financial statements, but it does not require transition accounting for leases that expire prior to the date of initial application. FASB extended this deadline from 2020 to 2022 due to the coronavirus crisis. The Company implemented the new standard for all office leases in August, 2022, effective as of January 1, 2022. The Company plans to apply the standard to their equipment leases, effective as of January 1, 2022 before December 31, 2022.

Subsequent Events

The Company has evaluated subsequent events through January 6, 2023. Refer to Note 8 for a summary of significant subsequent events.

Transactions

The transactions below were accounted for as business combinations in accordance with ASC 805, “Business Combinations.” The 2022 and 2021 operating results include the effects of the acquisitions from the transaction date forward.

Context Benefit Advisors – Asset Sale

On May 21, 2020, an Asset Purchase Agreement was executed by and among Context Benefit Advisors, LLC (“Context Benefit Advisors”), a wholly owned subsidiary of Maestro Health, LLC, and The Hilb Group of North Carolina, LLC, (“Hilb”) whereby Context Benefit Advisors sold to Hilb a portfolio of brokerage contracts, for an upfront cash consideration of $36,000. All assets in scope were subsequently transferred to Hilb.

Group Associates – Asset Sale

On December 28, 2020, an Asset Purchase Agreement was executed by and among Group Associates, Inc. (“Group Associates”), a wholly owned subsidiary of Maestro Health, LLC, and Benefit Partner, LLC d/b/a Salus Group (“Salus”), whereby Group Associates sold to Salus a portfolio of benefit administration and brokerage contracts, for an upfront consideration of $200,000. The transfer of the assets was completed during the second quarter of 2021 and trailing commissions due were settled by December 31, 2021.

At September 30, 2022 and December 31, 2021, property and equipment were comprised of the following:

|

|

9/30/2022 |

|

12/31/2021 |

|

|

|

|

|

Furniture, fixtures, and equipment |

$ |

7,480,296

|

$ |

7,443,136 |

Less accumulated depreciation and amortization |

|

3,697,619

|

|

2,985,881 |

|

|

|

|

|

Net Book Value of Property and Equipment |

$ |

3,782,677

|

$ |

4,457,255 |

Depreciation and amortization expense was $711,739 for the period ended September 30, 2022.

The accompanying notes are an integral part of these consolidated financial statements.

12

Maestro Health, LLC. and Subsidiaries

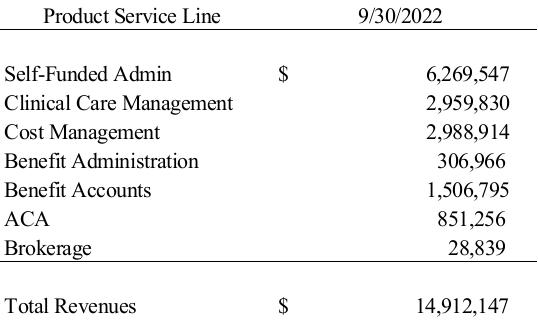

The following is a description of principal activities from which the Company generates its revenue:

Self-Funded (SF) administrative services of the Company principally generate revenue from providing services such as coordination of benefits, large claims management and adjudication, Electronic Data Interchange (EDI), as well as medical, dental and vision administration. Fees are billed and collected from employers on a per member basis and recognized in the period such services are rendered and earned.

Clinical Care Management (CCM) revenues principally generate revenue from providing Utilization Review (UR), acute case management, chronic condition management, complex condition management and biometric screenings. Revenues are billed and recognized when the services are performed.

Cost Management (CM) revenues are generated from a variety of services. Included are Out-of-network repricing management, PBM maintenance, alternative reimbursement strategies, repricing administration, virtual care options, as well as pharmacy cost containment solutions. Revenues are billed and recognized when the services are performed.

Benefit Administrative revenues are primarily generated from Enrollment Only Services, and Cobra administration. Fees are billed and collected from employers on a per member basis and recognized in the period such services are rendered and earned.

Benefit Accounts revenues are generated primarily from FSA, HSA, and transit administration services. Fees are billed and collected on a per participant basis and recognized in the period such services are rendered and earned.

ACA Reporting (form 1094/1095 reporting) revenues are generated by either a full-service or self-service option for monthly updating. Under the self-service option, the customer accesses the platform and makes their monthly updates themselves. Under the full-service option, the customer provides the Company a file, and the Company updates the platform on their behalf. Revenue recognition for the ACA product is addressed differently for different components:

Billing for ACA services is done in two parts, therefore the Company uses unbilled A/R and deferred revenue accounts when the contract begins and utilizes revenue recognition schedules to the recognize appropriately over the reporting period.

The accompanying notes are an integral part of these consolidated financial statements.

13

Maestro Health, LLC. and Subsidiaries

The following table presents revenues disaggregated by services line for the period ended September 30, 2022:

The Company does not have Goodwill or Intangible Assets as of September 30, 2022.

Leases

The Company has various non-cancelable operating lease agreements for office space and other equipment through 2028. ASC842 was implemented for the three outstanding office leases in August 2022, effective January 1, 2022. Right of Use Assets of $3,187,587 and Lease Liabilities of $6,202,697 were created. As of September 30, 2022, the net book value of the Right of Use Assets and outstanding Lease Liabilities were $2,863,260 and $5,658,123 respectively.

On March 1, 2018, the Company entered into a lease agreement for premises, comprised of 10,019 rentable square feet, in Southfield, Michigan. The lease term commenced on July 2, 2018 and will continue through and expire on July 31, 2023. In accordance with the commencement of this lease agreement, the Company vacated its premises (and terminated its lease) in Bingham Farms, Michigan. The landlord was informed that the Company intends to vacate the premises at lease expiration.

On July 24, 2018, the Company entered into an amended lease agreement for the Company’s corporate headquarters in Chicago, Illinois, where the Company expanded its occupied premises, extended the lease term, and modified other general lease provisions. The Company expanded its occupied premises by an additional 4,905 rentable square feet. The lease term commenced on November 1, 2018 and will continue through and expire on September 30, 2028.

On July 8, 2019, the Company entered into a lease agreement with Regus, in Bethesda, Maryland, for Office 719. The lease term commenced on July 15, 2019 and the current extension will expire on January 31, 2023. The Company intends to terminate the lease at the end of the current extension period.

On October 25, 2019, the Company entered into a lease agreement for residential housing for one of the Company’s Executive Officers. The premises are comprised of 3,200 rentable square feet, in Chicago, Illinois. The lease term commenced on December 1, 2019 and will continue through and expire on November 30, 2023. This lease will be transferred to the Company Executive effective October 31, 2022.

The accompanying notes are an integral part of these consolidated financial statements.

14

Maestro Health, LLC. and Subsidiaries

On December 19, 2019, the Company entered into a lease agreement for premises comprised of 31,475 rentable square feet in Charlotte, North Carolina. The lease term commenced on June 1, 2020 and will continue through and expire on May 31, 2029. In accordance with the commencement of this lease agreement, the Company vacated its prior office premises in Charlotte, North Carolina and terminated that lease at its expiration date of September 30, 2021.

On May 20, 2020, the Company entered into a lease agreement with Regus, in Bethesda, Maryland, for Office 720. The lease commenced on July 1, 2020 and was on a month-to-month basis. This lease was terminated on September 30, 2021.

The future minimum lease payments required for each of the following fiscal years ending are:

Year Ending December 31, |

Amount |

2022 |

$ 1,452,642 |

2023 |

1,355,988 |

2024 |

1,266,301 |

2025 |

1,309,409 |

2026 and Beyond |

5,404,434 |

Total |

$ 10,788,774 |

Legal Proceedings

From time to time, the Company is involved in various litigation matters arising in the ordinary course of its business.

The Company is under investigation as whether it is in compliance with the Privacy and Security Rules per the U.S. Department of Health and Human Services' Office for Civil Rights. The Company responded to several rounds of inquiries, the last being in October 2021. It remains unclear if further information will be requested or a penalty will be assessed.

Effective December 17, 2020, the Company elected to convert to a Limited Liability Corporation (LLC) owned by two partners. As a result, the Company will now be treated as a partnership and wrote off its deferred balances. For the 2021 and 2022 reporting periods, the Company’s net losses are absorbed by their owner/partners and reported within their financial statements. An agreement exists between the parties that any tax benefit that accrues to the partners from the Company’s net losses will be reinvested in the Company once those figures are finalized.

As of September 30, 2022, the Company did not have any material uncertain tax positions. The Company will be acquired by a public corporation effective October 31, 2022 and does not expect any material changes to its unrecognized tax benefits within the next 12 months. The Company classifies uncertain tax positions as non-current income tax liabilities unless expected to be paid within one year or otherwise directly related to an existing deferred tax asset, in which case the uncertain tax position is recorded net of the asset on the balance sheets. Interest and penalties are recognized in income tax expense. As of December 31, 2021, there were no accrued interest and penalties related to uncertain tax positions. The Company has filed income tax returns in the U.S. federal jurisdiction for all years since inception in 2013. For taxation years before 2017, the Company is no longer subject to U.S. Federal or state income tax examinations.

The accompanying notes are an integral part of these consolidated financial statements.

15

Maestro Health, LLC. and Subsidiaries

On February 5, 2020, the Company entered into a $10,000,000 loan agreement with AXA S.A., with a termination date as of August 5, 2020. The loan was received in full by the Company on February 5, 2020. On August 5, 2020, the loan was subsequently increased to $21,400,000, with a new termination date as of August 5, 2021. The additional amount was received in full by the Company on August 5, 2020. On August 5, 2021, the loan was extended to a termination date as of July 5, 2022. On May 12, 2022, the loan was consolidated with all other outstanding loans and extended to a termination date of May 13, 2023.

On April 15, 2020, the Company entered into a $10,000,000 loan agreement with AXA S.A., with a termination date as of October 15, 2020. The loan was received in full by the Company on April 15, 2020. On October 15, 2020, the loan was extended to a termination date as of October 15, 2021. On October 13, 2021, the loan was extended to a termination date as of July 5, 2022. On May 12, 2022, the loan was consolidated with all other outstanding loans and extended to a termination date of May 13, 2023.

On February 24, 2021, the Company entered into a $10,000,000 loan agreement with AXA S.A., with a termination date as of February 28, 2022. The loan was received in full by the Company on February 26, 2021. On February 28, 2022, the loan was extended to a termination date as of July 5, 2022. On May 12, 2022, the loan was consolidated with all other outstanding loans and extended to a termination date of May 13, 2023.

On June 17, 2021, the Company entered into a $12,000,000 loan agreement with AXA S.A., with a termination date as of June 17, 2022. The loan was received in full by the Company on June 17, 2021. On May 12, 2022, the loan was consolidated with all other outstanding loans and extended to a termination date of May 13, 2023.

On May 13, 2022, the Company consolidated all outstanding loans with AXA S.A. and entered into a new loan agreement with AXA S.A. for $59.9m, with a termination date of May 12, 2023.

On December 17, 2020, Maestro Health, Inc. was converted into Maestro Health, LLC. As a consequence, all 948 outstanding shares of Common Stock were retired and converted into 948 Membership Units. The total membership units are held by the Company’s two owners. AXA Holdings U.S. Holdings, Inc. has 748 membership units and Seaview Re Holdings Inc. has 200 membership units. There have been no changes in common stock as of September 30, 2022.

Maestro Health, LLC Acquisition by Marpai, Inc.

On October 31, 2022, the acquisition of Maestro Health, LLC by Marpai, Inc. was closed. As part of the agreement, Marpai paid $100.00 to the Equity Seller (X.L. America, Inc. and Seaview Re Holdings, Inc.) and promised to pay the Debt Holder (AXA S.A.) $5,000,000 on 12/31/2024, $11,000,000 on 12/31/2025 and $19,000,000 on 12/31/2026 (inclusive of interest), thereby transferring the Debt Holder’s receivable of $59,900,000 to Marpai. The debt holder cancelled its claim against Maestro Health for the debt instrument and any interest accrued as of October 31, 2022. The agreement also required that AXA guarantee a cash balance upon closing of $15,700,000 to fund Maestro’s operations through 2023. Of which, an amount of $14 million cash transfer was received on October 27, 2022, as disclosed under Note 1.

The accompanying notes are an integral part of these consolidated financial statements.

16