Exhibit 99.3

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

Introduction

The following unaudited pro forma condensed combined financial information is based on the historical consolidated financial statements of Marpai, Inc. (“Marpai”) and Maestro Health, LLC (“Maestro”), after giving effect to Marpai’s acquisition of Maestro. The notes to the unaudited pro forma condensed combined financial information describe the reclassifications and transaction accounting adjustments to the financial information presented. Hereinafter, Marpai and Maestro are collectively referred to as the “Companies,” and the Companies, subsequent to the Acquisition, are referred to herein as the “Combined Company.”

The following unaudited pro forma condensed combined financial information has been prepared in accordance with Article 11 of Regulation S-X, as amended by the final rule, Release No. 33-10786, “Amendments to Financial Disclosures about Acquired and Disposed Businesses,” and presents the combination of the historical financial information of Marpai and Maestro adjusted to give effect to Marpai’s acquisition of Maestro.

The unaudited pro forma condensed combined balance sheet, which has been presented for the Combined Company as of September 30, 2022, gives effect to the transactions summarized below, as if they were consummated on September 30, 2022.

The unaudited pro forma condensed combined statements of operations, which have been presented for the nine months ended September 30, 2022, gives effect to the transactions summarized below, as if they had occurred on January 1, 2021, the beginning of the earliest period presented.

The unaudited pro forma condensed combined statements of operations, which have been presented for the year ended December 31, 2021, give effect to the transactions summarized below, as if they had occurred on January 1, 2021, the beginning of the earliest period presented. Additionally, the unaudited pro forma condensed combined statement of

operations for the year ended December 31, 2021 reflects the impact of the Continental Benefits, LLC (“Continental Benefits”) acquisition by Marpai as if it occurred on January 1, 2021.

Description of the Transaction

On August 4, 2022, Marpai, a Delaware corporation entered into a Membership Interest Purchase Agreement (the “Agreement”) by and among XL America Inc., a Delaware corporation, Seaview Re Holdings Inc., a Delaware corporation (XL America Inc. and Seaview Re Holdings Inc. are collectively referred to herein as the “Equity Sellers”), and AXA S.A., a French société anonyme (the “Debt Seller,” and, together with the Equity Sellers, collectively, the “Sellers”). Pursuant to the terms of the Agreement, the Company agreed to acquire all of the membership interests (the “Units”) of Maestro , a Delaware limited liability company (the “Acquisition”). The Equity Sellers own an aggregate of 100% of the issued and outstanding Units of Maestro.

Maestro is a third-party administrator for employee health and benefits, which offers an end-to-end health plan solution, integrating care management and cost containment for its customers. The Agreement contains representations and warranties customary for transactions of this nature negotiated between sophisticated purchasers and sellers acting at arm’s length, certain of which are qualified as to materiality and knowledge and subject to reasonable exceptions. The closing of the Acquisition is subject to certain customary closing conditions as contained in the Agreement, including: (i) that the Equity Sellers shall have sold, assigned, transferred, conveyed and delivered to Marpai all of the Equity Sellers’ rights, title, and interests in and to all of the Units; and (ii) the Debt Seller shall have irrevocably transferred and assigned to Marpai all of the Debt Seller’s rights and obligations with respect to receiving payments under that certain Term Loan Agreement, dated May 11, 2022, by and between the Debt Seller and Maestro, in the principal amount of $59,900,000 (the “AXA Note”).

In addition, the Sellers agreed that on the closing date Maestro’s free cash balance will be not less than $15,790,000, and that net working capital excluding cash will be between negative $1,485,128 and negative $2,758,094.

In consideration for Marpai’s acquisition of the Units, Marpai has agreed to pay the Sellers an aggregate purchase price (the “Purchase Price”) of $19,900,000 determined on the closing date (the “Base Purchase Price”), which shall be payable on or before April 1, 2024 (the “Payment Date”), and shall accrue interest until such time that is paid, such that on the Payment Date the Purchase Price, plus all accrued and unpaid interest, shall equal $22,100,000 (for clarity, the Base Purchase Price shall be adjusted, in each case, pursuant to the terms of the Agreement). Marpai agreed to pay the Equity Sellers an amount of $100 with the balance of the Purchase Price to be paid to the Debt Seller for the repayment of the AXA Note. In no event will Marpai be responsible for any further payments for the repayment of the AXA Note other than the repayment of the Purchase Price as provided in the Agreement. Following the Payment Date, any unpaid portion of the Purchase Price shall accrue interest at ten percent (10%) per annum, compounding annually, calculated on the basis of a 365-day year for the actual number of days elapsed (the “Specified Rate”), and shall be repaid as promptly as practicable to the Debt Seller. In addition, in the event Marpai or its subsidiaries receive proceeds from the sale of any securities in a private placement or public offering of securities (each an “Offering”), then Marpai shall pay to the Debt Seller an amount equal to thirty-five percent (35%) of the net proceeds of the Offering no later than sixty (60) days after the closing of Offering until such time as the Purchase Price has been paid in full.

Notwithstanding the foregoing, Marpai shall be required to make accumulated annual payments to the Debt Seller, representing the Purchase Price, as follows: (i) $5,000,000 to be paid by December 31, 2024, (ii) $11,000,000 to be paid by December 31, 2025, and (iii) $9,000,000 to be paid by December 31, 2026. In addition, Marpai shall be obligated to pay the full amount of any remaining unpaid Purchase Price (inclusive of any accrued interest at the Specified Rate) by no later than year-end 2027, and in no event shall the Company be required to pay total cash consideration equal to more than the aggregate amount of the Purchase Price (as adjusted pursuant to the terms of the Agreement).

Anticipated Accounting Treatment for the Acquisition

The Acquisition is accounted for under the acquisition method of accounting in accordance with Accounting Standards Codification (“ASC”) Topic 805, Business Combinations (“ASC 805”). Under the acquisition method of accounting for purposes of the unaudited pro forma condensed combined financial information, management of Marpai has deemed Marpai to be the accounting acquirer and determined a preliminary estimated purchase price, calculated as described in Note 2: Preliminary Estimated Purchase Price Allocation to the unaudited pro forma condensed combined financial information. The Maestro assets acquired and liabilities assumed in connection with the Acquisition are recorded at their estimated acquisition date fair values. A final determination of these estimated fair values will be based on the actual net assets of Maestro that existed as of November 1, 2022, the date of the Closing. Differences between these preliminary estimates and the final acquisition accounting may occur and these differences could be material.

The acquisition method of accounting is based on ASC 805 and uses the fair value concepts defined in ASC Topic 820, Fair Value Measurements (“ASC 820”). ASC 820 defines fair value, establishes a framework for measuring fair value, and sets forth a fair value hierarchy that prioritizes and ranks the level of observability of inputs used to develop the fair value measurements. Fair value is defined in ASC 820 as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.” This is an exit price concept for the valuation of the asset or liability. In addition, market participants are assumed to be buyers and sellers in the principal (or the most advantageous) market for the asset or liability. Fair value measurements for a non-financial asset assume the highest and best use by these market participants. Many of these fair value measurements can be highly subjective, and it is possible that other professionals applying reasonable judgment to the same facts and circumstances, could develop and support a range of alternative estimated amounts.

Basis of Pro Forma Presentation

The historical financial information has been adjusted to give pro forma effect to events that are directly attributable to the Acquisition. The adjustments presented on the unaudited pro forma condensed combined financial statements have been identified and presented to provide relevant information necessary for an accurate understanding of the combined company upon consummation of the Acquisition.

The unaudited pro forma condensed combined financial information should be read in conjunction with the accompanying notes to the unaudited pro forma condensed combined financial information. In addition, the unaudited pro forma condensed combined financial information was based on and should be read in conjunction with the:

|

● |

Unaudited condensed consolidated financial statements of Marpai as of September 30, 2022 and for the nine months ended September 30, 2022 and year ended December 31, 2021 and the related notes, which can be found in Marpai’s Form 10Q filing for the quarter ended September 30, 2022 and in Marpai’s Form 10K filing for the year ended December 31, 2021, respectively; and |

|

● |

Unaudited condensed consolidated financial statements of Maestro as of September 30, 2022 and for the nine months ended September 30, 2022 and year ended December 31, 2021 and the related notes, which are included elsewhere in this filing. |

The unaudited pro forma condensed combined financial information does not reflect the costs of any integration activities or benefits that may result from realization of future cost savings from operating efficiencies or revenue synergies that may result from the Acquisition.

Marpai and Maestro have not had any historical relationship prior to the Acquisition. Accordingly, no pro forma adjustments were required to eliminate activities between the companies.

The unaudited pro forma condensed combined financial information is based on the assumptions and adjustments that are described in the accompanying notes. The pro forma adjustments reflected in the unaudited pro forma condensed combined financial information are preliminary and based on estimates, subject to further revision as additional information becomes available and additional analyses are performed and have been made solely for the purpose of providing unaudited pro forma condensed combined financial information. Differences between these preliminary adjustments reflected in the unaudited pro forma condensed combined financial information as of September 30, 2022 and the final application of the accounting for the Acquisition, may occur and those differences could be material. In addition, differences between the preliminary and final adjustments may occur, as well as other changes in assets and liabilities between September 30, 2022 and the closing of the Acquisition.

The unaudited pro forma condensed combined balance sheet does not purport to represent, and is not necessarily indicative of, what the actual financial condition of the Combined Company would have been had the Acquisition taken place on September 30, 2022, nor is it indicative of the financial condition of the Combined Company as of any future date. The unaudited pro forma condensed combined statements of operations do not purport to represent, and are not necessarily indicative of, what the actual results of operations of the Combined Company would have been had the Acquisition taken place on January 1, 2021, nor are they indicative of the results of operations of the Combined Company for any future period.

The unaudited pro forma condensed combined financial information has been prepared for illustrative purposes only and are not necessarily indicative of the financial position or results of operations in future periods or the results that actually would have been realized had Marpai and Maestro been a combined company during the specified periods.

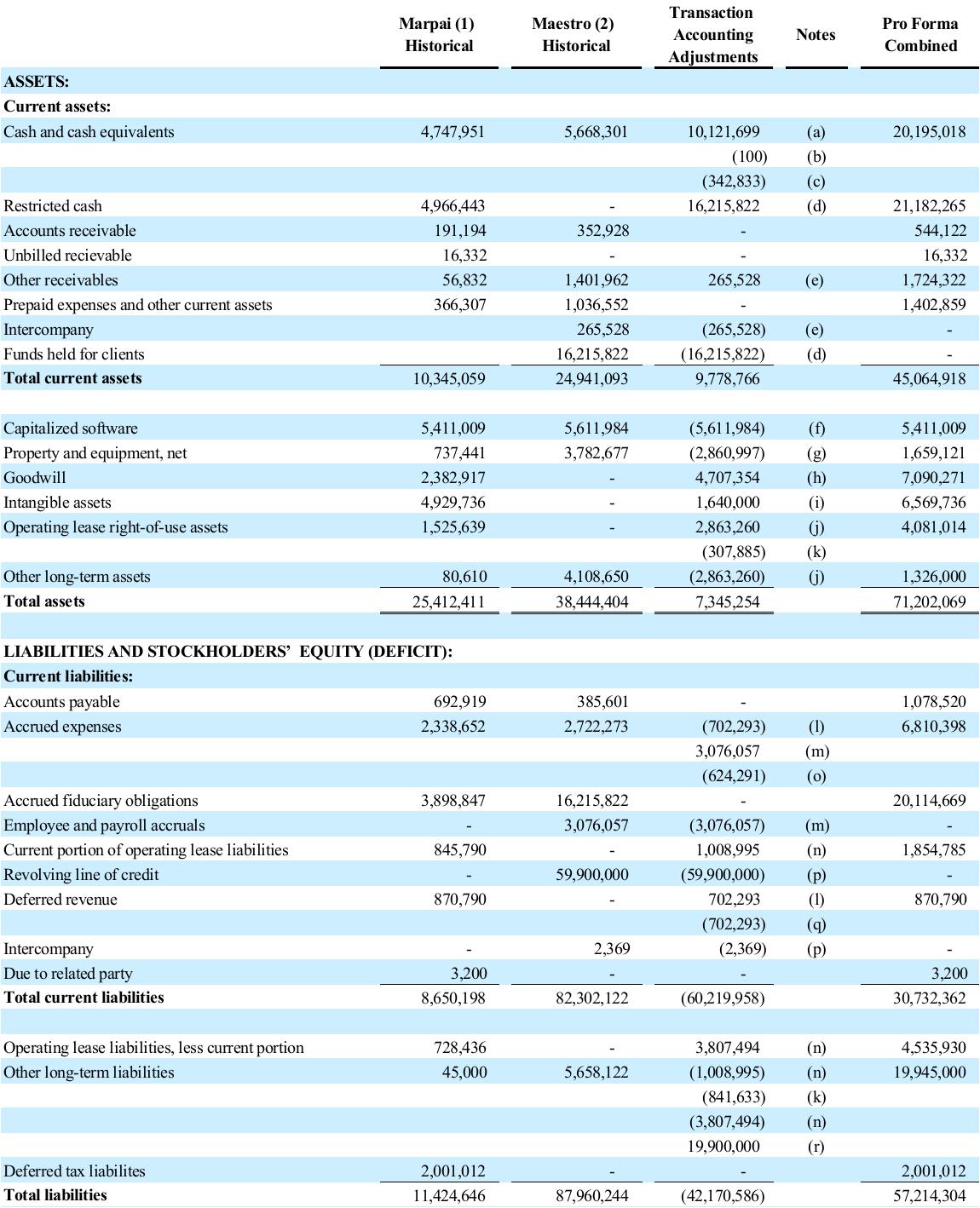

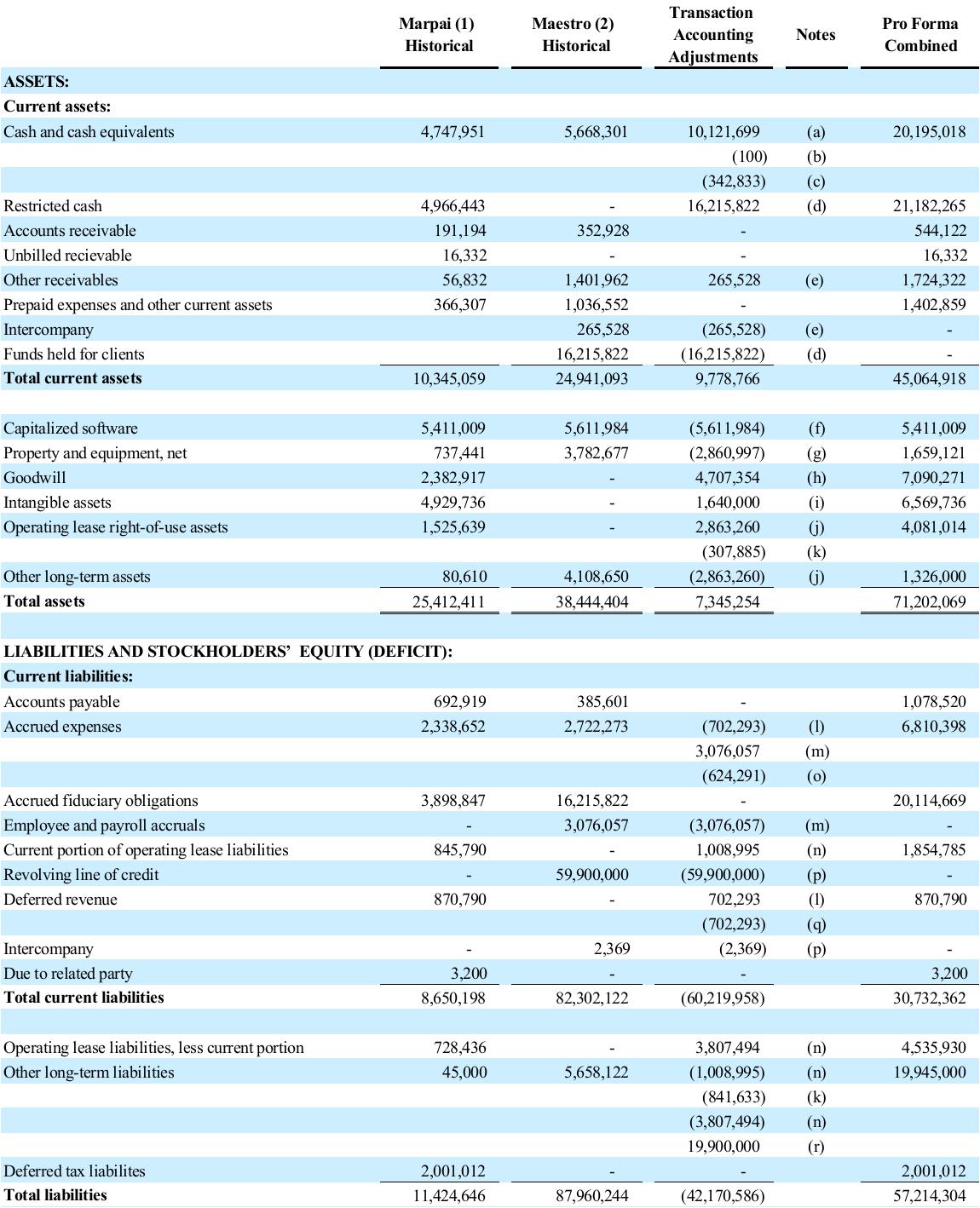

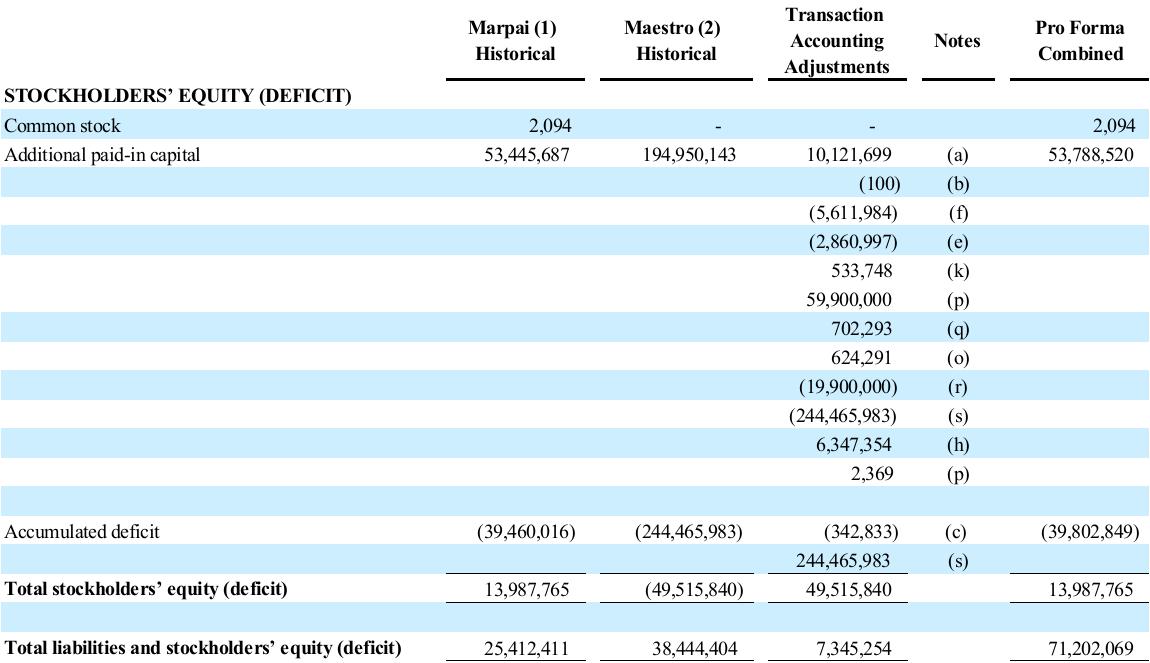

UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEET

AS OF SEPTEMBER 30, 2022

|

(1) |

Derived from Marpai’s unaudited condensed consolidated balance sheet as of September 30, 2022. |

|

(2) |

Derived from Maestro’s unaudited condensed consolidated balance sheet as of September 30, 2022. |

See accompanying notes to the Unaudited Pro Forma Condensed Combined Financial Information

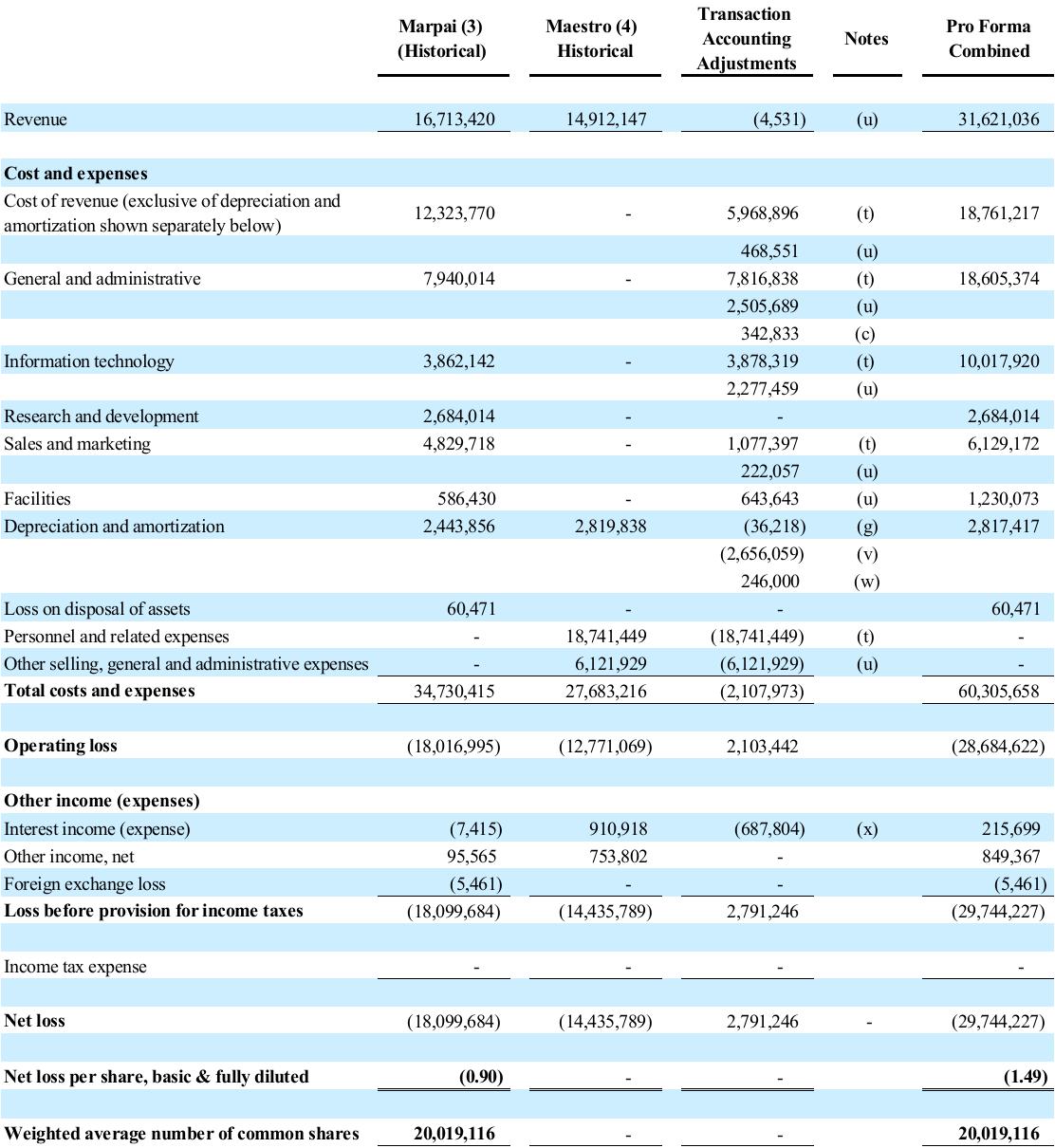

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

NINE MONTHS ENDED SEPTEMBER 30, 2022

|

(3) |

Derived from Marpai’s unaudited condensed consolidated statement of operations for the nine months ended September 30, 2022. |

|

(4) |

Derived from Maestro’s unaudited condensed consolidated statement of operations for the nine months ended September 30, 2022. |

See accompanying notes to the Unaudited Pro Forma Condensed Combined Financial Information

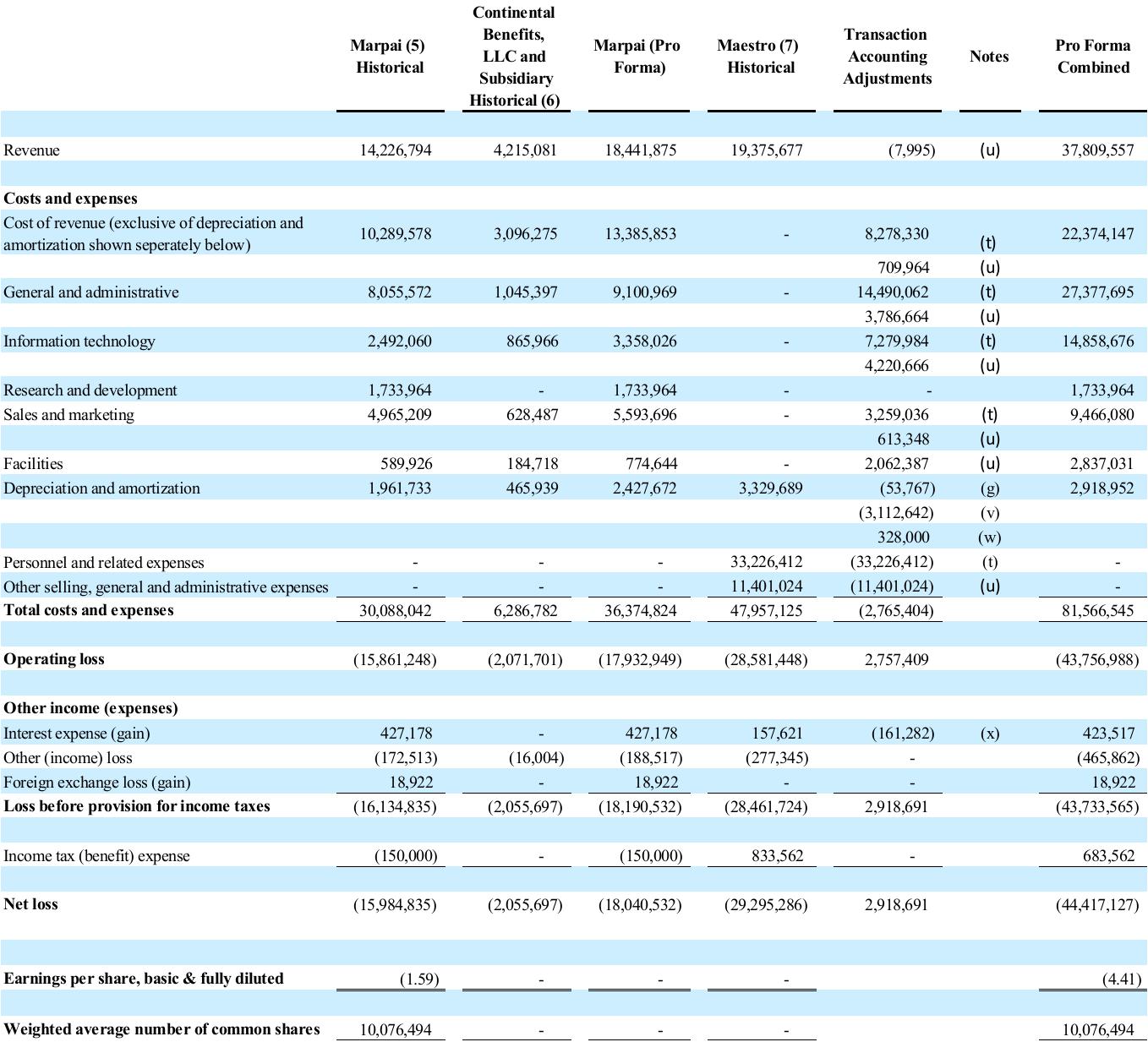

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS

YEAR ENDED DECEMBER 31, 2021

|

(5) |

Derived from Marpai’s audited consolidated statement of operations for the year ended December 31, 2021. |

|

(6) |

Represents the addition of Continental Benefits pre-acquisition activity for the period January 1, 2021 through March 31, 2021 and pro forma adjustments related to the Continental Benefits acquisition which is derived from Marpai’s preliminary prospectus filing, dated October 25, 2021, for the period ended June 30, 2021. |

|

(7) |

Derived from Maestro’s audited consolidated statement of operations for the year ended December 31, 2021. |

See accompanying notes to the Unaudited Pro Forma Condensed Combined Financial Information

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

1. BASIS OF PRESENTATION AND DESCRIPTION OF THE ACQUISITION

On November 1, 2022, pursuant to the terms of the Membership Interest Purchase Agreement (the “Agreement”), Marpai, Inc. acquired all of the outstanding Units of Maestro. For further details on the Acquisition see the section titled Description of the Transaction.

The unaudited pro forma condensed combined financial information presents the pro forma condensed combined financial position and results of operations of the Combined Company based upon the historical consolidated financial statements of Marpai. and Maestro, after giving effect to transaction accounting adjustments related to the Acquisition and are intended to reflect the impact of such on the Combined Company’s historical consolidated financial statements.

The pro forma adjustments have been prepared as if the Acquisition had been consummated on September 30, 2022 in the case of the unaudited pro forma condensed combined balance sheet, and as if the Continental Benefits acquisition, which was consummated by Marpai on April 1, 2021, and the Acquisition had been consummated on January 1, 2021, the beginning of the earliest period presented, in the case of the unaudited pro forma condensed combined statements of operations.

The adjustments presented in the unaudited pro forma condensed combined financial information have been identified and presented to provide relevant information necessary for an accurate understanding of Marpai after giving effect to the Acquisition. Management has made significant estimates and assumptions in its determination of the pro forma adjustments. As the unaudited pro forma condensed combined financial information has been prepared based on these preliminary estimates, the final amounts recorded may differ materially from the information presented.

The unaudited pro forma condensed combined financial information has been prepared using the following:

|

● |

Unaudited condensed consolidated financial statements of Marpai as of September 30, 2022 and for the nine months ended September 30, 2022 and historical statement of operations for the year ended December 31, 2021 and the related notes, which can be found in Marpai’s Form 10Q filing for the quarter ended September 30, 2022 and in Marpai’s Form 10K filing for the year ended December 31, 2021, respectively;

Unaudited condensed consolidated financial statements of Marpai as of and for the period ended June 30, 2021 and the related notes, which can be found in Marpai’s preliminary prospectus filing, dated October 25, 2021; and |

|

● |

Unaudited condensed consolidated financial statements of Maestro as of September 30, 2022 and for the nine months ended September 30, 2022 and historical statement of operations for the year ended December 31, 2021 and the related notes, which are included elsewhere in this filing. |

The Acquisition is being accounted for as a business combination, with Marpai treated as the “acquirer” and Maestro treated as the “acquired” company for financial reporting purposes. For accounting purposes, the acquirer is the entity that has obtained control of another entity and, thus, consummated a business combination. Management has determined that Marpai is the accounting acquirer and Maestro is deemed to be the acquired company for financial reporting purposes, as Marpai acquired all of the equity of Maestro for non-equity consideration and the Sellers do not hold any ownership and voting interest in Marpai.

Under the acquisition method of accounting, the total estimated purchase price of an acquisition is allocated to the net tangible and intangible assets based on their estimated fair values. Such valuations are based on available information and certain assumptions that management of Marpai believe are reasonable. The preliminary allocation of the estimated purchase price to the tangible and intangible assets acquired and liabilities assumed is based on various preliminary estimates. Accordingly, the pro forma adjustments are preliminary and have been made solely for the purpose of providing the unaudited pro forma condensed combined financial information. Differences between these

preliminary estimates and the final acquisition accounting, which will be based on the actual net tangible and identifiable intangible assets that exist as of the closing of the Acquisition, may occur and these differences could be material. The differences, if any, could have a material impact on the accompanying unaudited pro forma condensed combined financial information and the Combined Company’s future results of operations and financial position.

In consideration for Marpai’s acquisition of the Units, Marpai has agreed to pay the Sellers an aggregate purchase price (the “Purchase Price”) of $19,900,000 determined on the closing date (the “Base Purchase Price”), which shall be payable on or before April 1, 2024 (the “Payment Date”), and shall accrue interest until such time that is paid, such that on the Payment Date the Purchase Price, plus all accrued and unpaid interest, shall equal $22,100,000 (for clarity, the Base Purchase Price shall be adjusted, in each case, pursuant to the terms of the Agreement). Marpai agreed to pay the Equity Sellers an amount of $100 with the balance of the Purchase Price to be paid to the Debt Seller for the repayment of the AXA Note. In no event will Marpai be responsible for any further payments for the repayment of the AXA Note other than the repayment of the Purchase Price as provided in the Agreement.

The unaudited pro forma condensed combined balance sheet and statements of operations include certain reclassifications to align the historical financial statement presentation of Marpai and Maestro. See Notes (d), (e), (j), (l), (m), (n), (t), and (u) in Note 3: Adjustments to Unaudited Pro Forma Condensed Combined Financial Information herein for additional information on the reclassifications.

The unaudited pro forma condensed combined financial information does not reflect the following:

|

● |

Income tax effects of the pro forma adjustments. The Combined Company’s management believes this unaudited pro forma condensed combined financial information to not be meaningful given the Combined Company incurred significant losses during the historical periods presented. |

|

● |

Restructuring or integration activities that have yet to be determined or other costs that may be incurred to achieve cost or growth synergies of the Combined Company. As no assurance can be made that the costs will be incurred or the cost or growth synergies will be achieved, no adjustment has been made. |

In addition, the unaudited pro forma condensed combined financial information does not necessarily reflect what the Combined Company’s financial condition or results of operations would have been had the Acquisition occurred on the dates indicated. They also may not be useful in predicting the future financial condition and results of operations of the Combined Company. The actual financial position and results of operations may differ significantly from the pro forma amounts reflected herein due to a variety of factors.

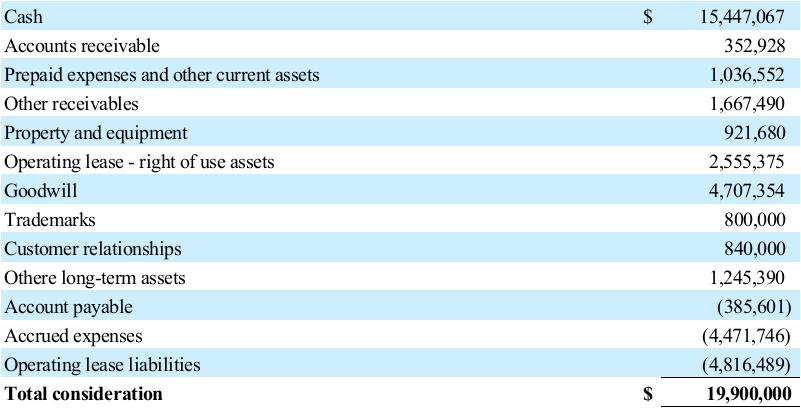

2. PRELIMINARY ESTIMATED PURCHASE PRICE ALLOCATION

The Company has performed a preliminary valuation analysis and accordingly, the pro forma adjustments include a preliminary allocation of the purchase price of Maestro to the estimated fair values of assets acquired and liabilities assumed at the acquisition date based on certain currently available information and certain assumptions and methodologies that management believes are reasonable under the circumstances. The final allocation of the purchase price could differ materially from the preliminary allocation primarily because market prices, interest rates and other valuation variables will fluctuate over time and be different at the time of completion of the Acquisition compared to the amounts assumed for the pro forma adjustments.

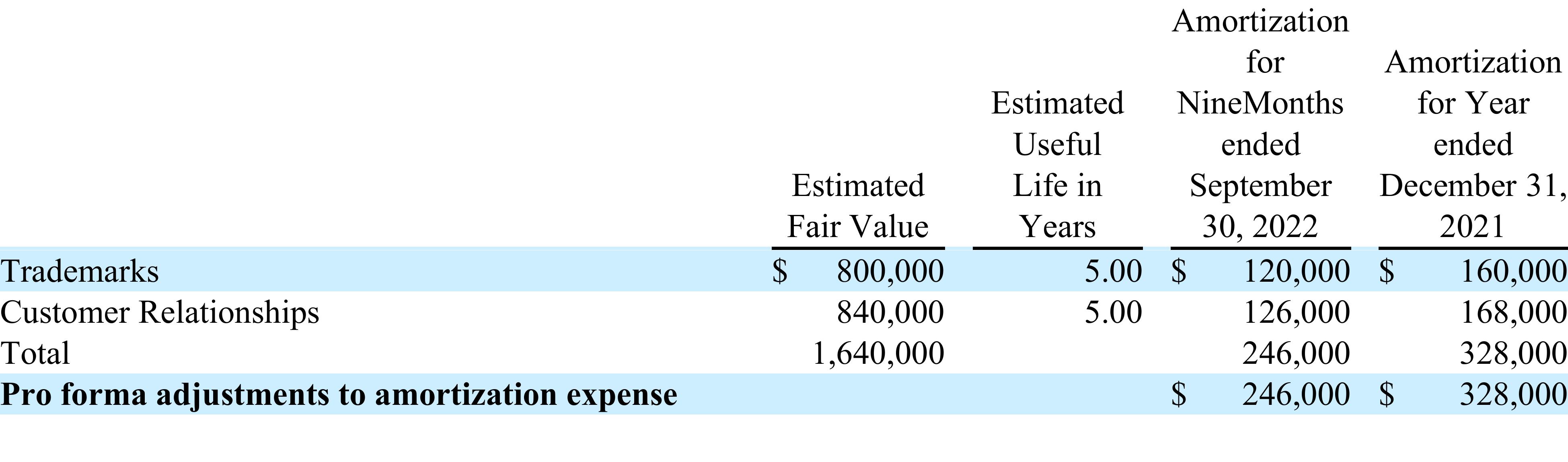

The following table summarizes the allocation of the preliminary purchase:

This preliminary purchase price allocation has been used to prepare the pro forma adjustments in the unaudited pro forma condensed combined balance sheet and statements of operations. The final purchase price allocation will be determined when the Combined Company has completed the detailed valuations and necessary calculations. The final allocation could differ materially from the preliminary allocation used in the pro forma adjustments. The final allocation may include (1) changes in fair values of property and equipment, (2) changes in allocations to intangible assets such as trademarks and customer relationships as well as goodwill and (3) other changes to assets and liabilities. |

3. |

ADJUSTMENTS TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION |

The following unaudited pro forma condensed combined financial information has been prepared in accordance with Article 11 of Regulation S-X.

Adjustments to Unaudited Pro Forma Condensed Combined Balance Sheet

The transaction accounting adjustments included in the unaudited pro forma condensed combined balance sheet as of September 30, 2022 are as follows:

Adjustments to Unaudited Pro Forma Condensed Combined Statements of Operations

The transaction accounting adjustments included in the unaudited pro forma condensed combined statements of operations for the nine months ended September 30, 2022, and year ended December 31, 2021 are as follows: