| MarpaiHealth.com (NASDAQ: MRAI) Company Presentation February 2023 Exhibit 99.1

| 2 Forward Looking Statements This presentation and the statements of representatives and partners of Marpai, Inc. (the “Company”) related thereto contain or may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other U.S. Federal securities laws, as amended. Statements that are not statements of historical fact may be deemed to be forward-looking statements. For example, the Company is using forward-looking statements in this presentation when it discusses the benefits to be derived from the Company’s products, the expected time line of certain planned Company events, the expected benefits to be derived from the acquisition of Maestro Health, including the number of lives, expected revenues, the cash on hand and the Company’s trends, market penetration and growth in the future. Without limiting the generality of the foregoing, words such as "plan," "project," "potential," "seek," "may," "will," "expect," "believe," "anticipate," "intend," "could," "estimate" or "continue" are intended to identify forward-looking statements. Forward-looking statements are based on management’s current expectations, estimates, projections, and assumptions about future events, and are subject to several factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions about the Company, which are difficult to predict, including projections of the Company’s future financial results, its anticipated growth strategies, and anticipated trends in its business and in the market generally. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect the Company’s current expectations and speak only as of the date of this presentation. Actual results may differ materially from the Company’s current expectations depending upon a number of factors. These factors include, among others, adverse changes in general economic and market conditions, competitive factors including but not limited to pricing pressures and new product introductions, uncertainty of customer acceptance of new product offerings and market changes, risks associated with managing the growth of the business. Additional factors that could cause or contribute to differences between the Company's actual results and forward-looking statements include, but are not limited to, those risks discussed in the Company's filings with the U.S. Securities and Exchange Commission (the “SEC”), including, but not limited to, the risks detailed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and any subsequent filings with the SEC. Readers are cautioned that actual results (including, without limitation, the timing for and results of the Company's plans as described herein) may differ significantly from those set forth in the forward-looking statements. The Company undertakes no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

We use advanced AI, predictive analytics and SMART automation with the goal of reducing costs for employers while increasing health outcomes for their employees. Building the Health Plan of the Future HEALTH COSTS Proprietary and Confidential. © Marpai, Inc. 2023

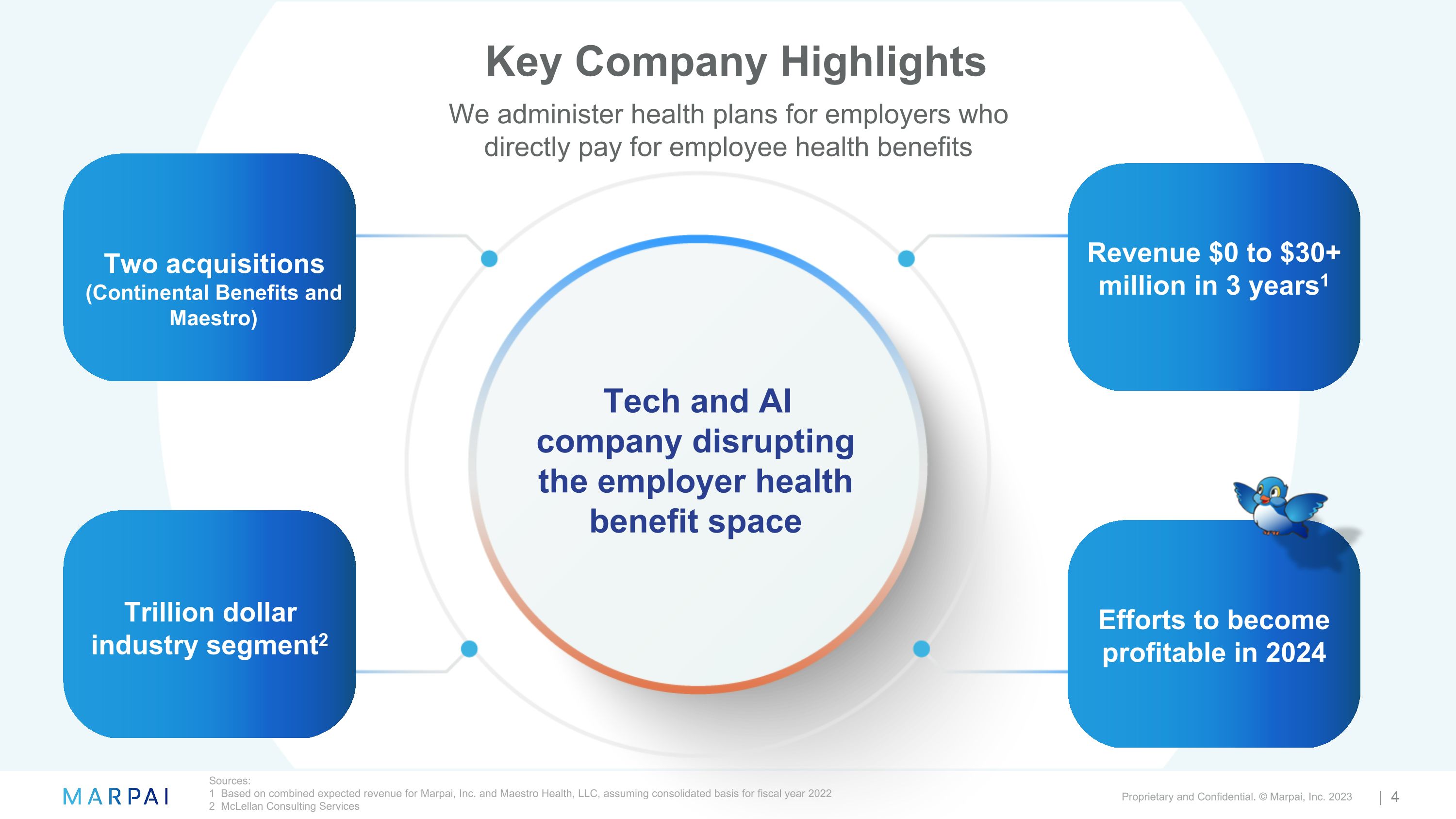

Key Company Highlights Tech and AI company disrupting the employer health benefit space We administer health plans for employers who directly pay for employee health benefits Trillion dollar industry segment2 Two acquisitions (Continental Benefits and Maestro) Revenue $0 to $30+ million in 3 years1 Efforts to become profitable in 2024 Sources: 1 Based on combined expected revenue for Marpai, Inc. and Maestro Health, LLC, assuming consolidated basis for fiscal year 2022 2 McLellan Consulting Services

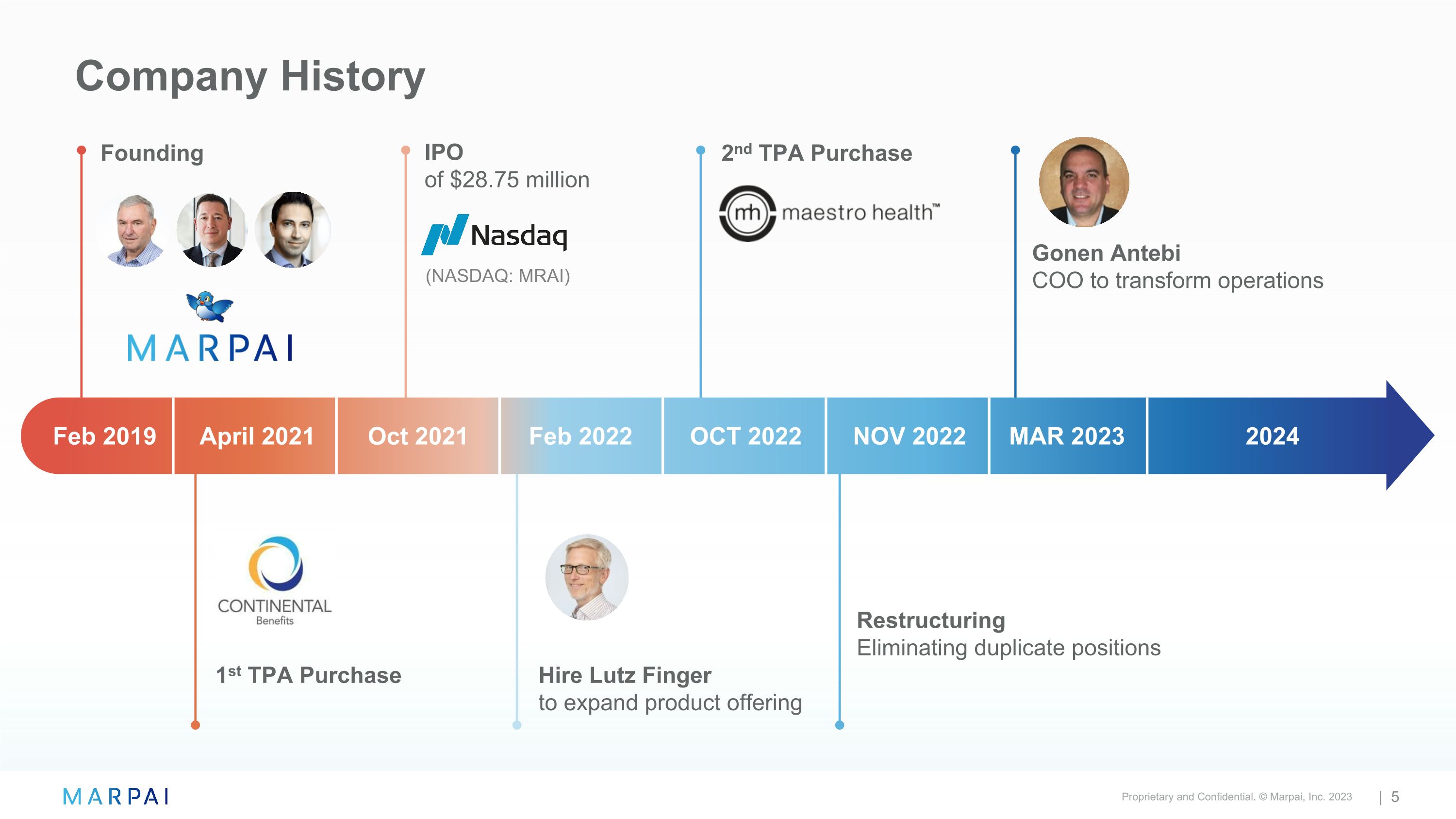

Feb 2019 April 2021 Oct 2021 Feb 2022 OCT 2022 NOV 2022 MAR 2023 2024 Founding 1st TPA Purchase IPO of $28.75 million 2nd TPA Purchase Hire Lutz Finger to expand product offering Restructuring Eliminating duplicate positions (NASDAQ: MRAI) Company History Gonen Antebi COO to transform operations

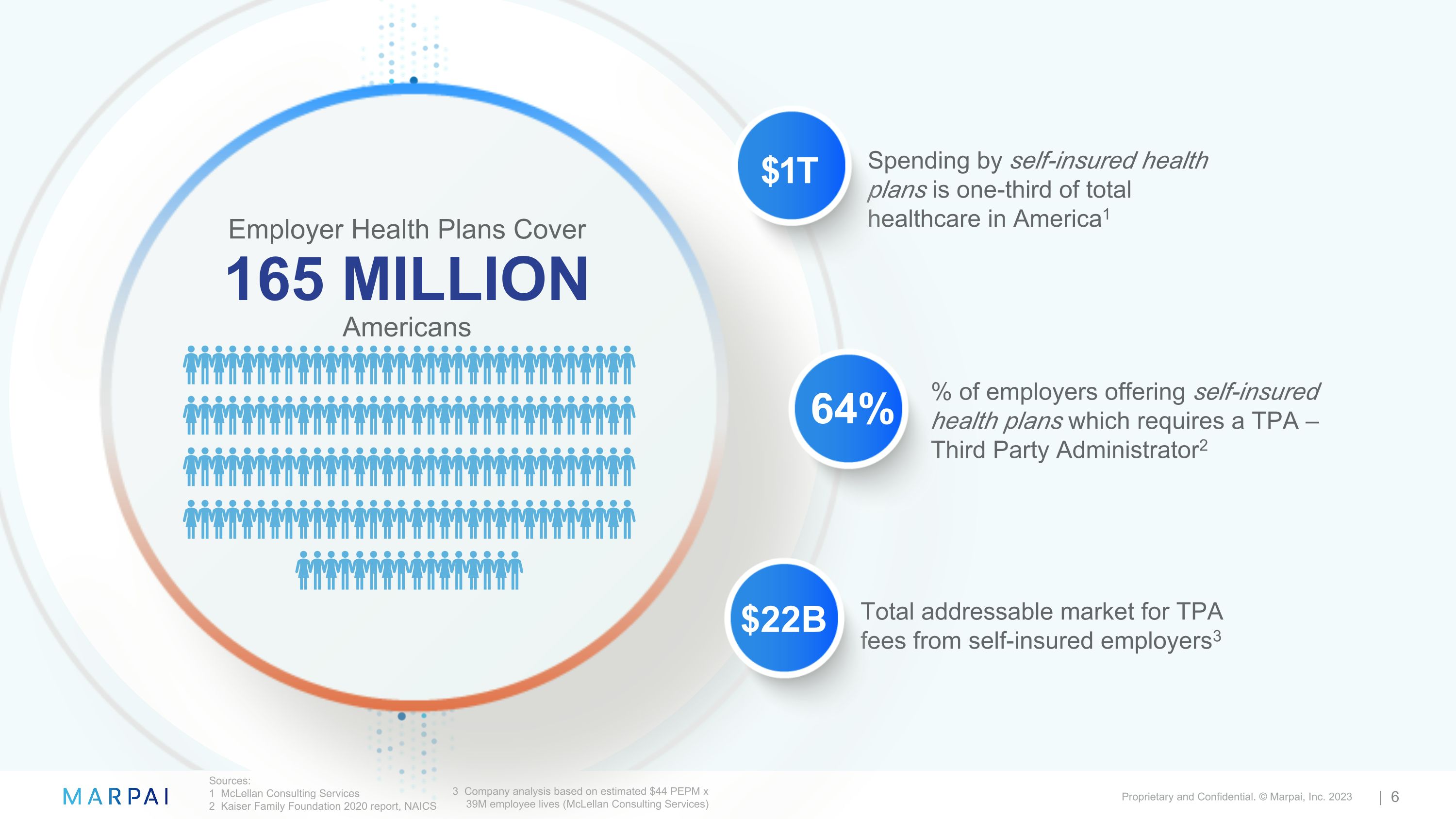

Total addressable market for TPA fees from self-insured employers3 % of employers offering self-insured health plans which requires a TPA – Third Party Administrator2 Spending by self-insured health plans is one-third of total healthcare in America1 Employer Health Plans Cover 165 MILLION Americans $22B 64% $1T Sources: 1 McLellan Consulting Services 2 Kaiser Family Foundation 2020 report, NAICS 3 Company analysis based on estimated $44 PEPM x 39M employee lives (McLellan Consulting Services)

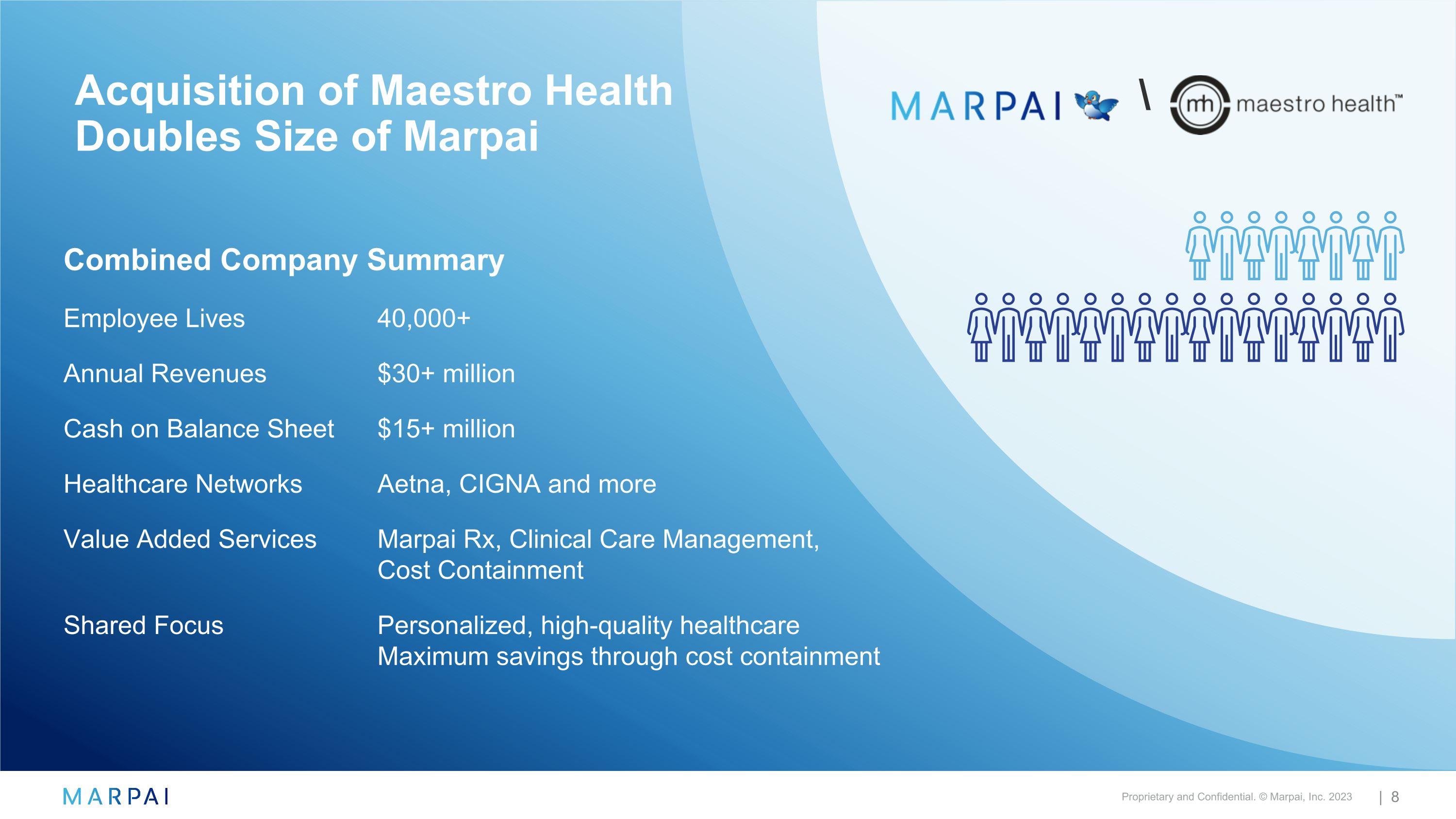

Acquisition of Maestro Health Doubles Size of Marpai Combined Company Summary Employee Lives 40,000+ Annual Revenues $30+ million Cash on Balance Sheet $15+ million Healthcare Networks Aetna, CIGNA and more Value Added Services Marpai Rx, Clinical Care Management, Cost Containment Shared Focus Personalized, high-quality healthcare Maximum savings through cost containment \

Represents Maestro Health’s existing services Represents Marpai’s existing services More Solutions to Sell Existing and Future Clients \ Marpai Cares AI-powered predictions and matching of members with proactive care Cost Containment Rx and out-of-network savings Care Management Nurses and clinical programs for high-risk members Value-Based Care Ecosystem of VBC vendors Marpai Rx Prescription medication savings Health Plan Administration

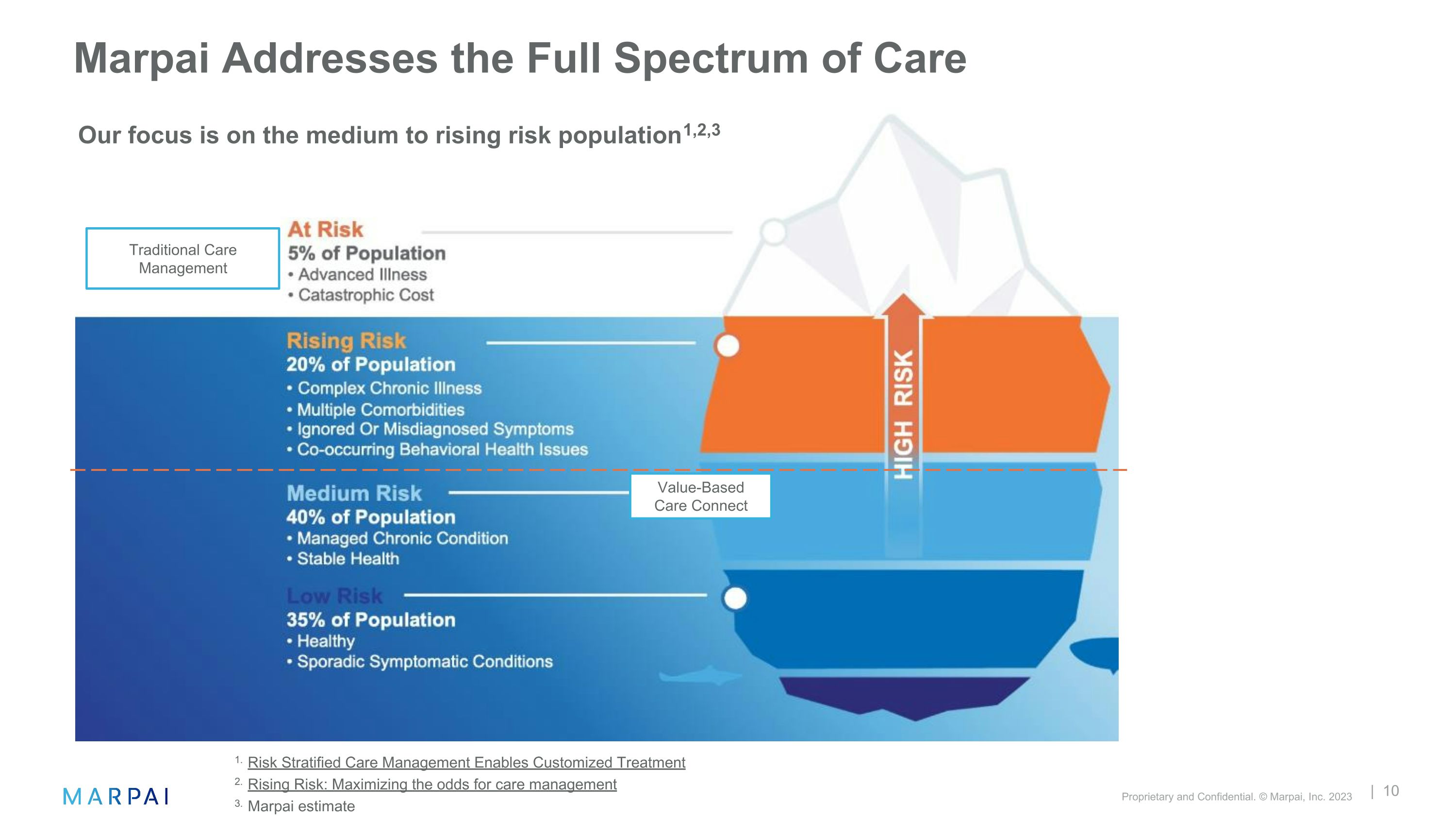

Marpai Addresses the Full Spectrum of Care 1. Risk Stratified Care Management Enables Customized Treatment 2. Rising Risk: Maximizing the odds for care management 3. Marpai estimate Traditional Care Management Our focus is on the medium to rising risk population1,2,3 Value-Based Care Connect

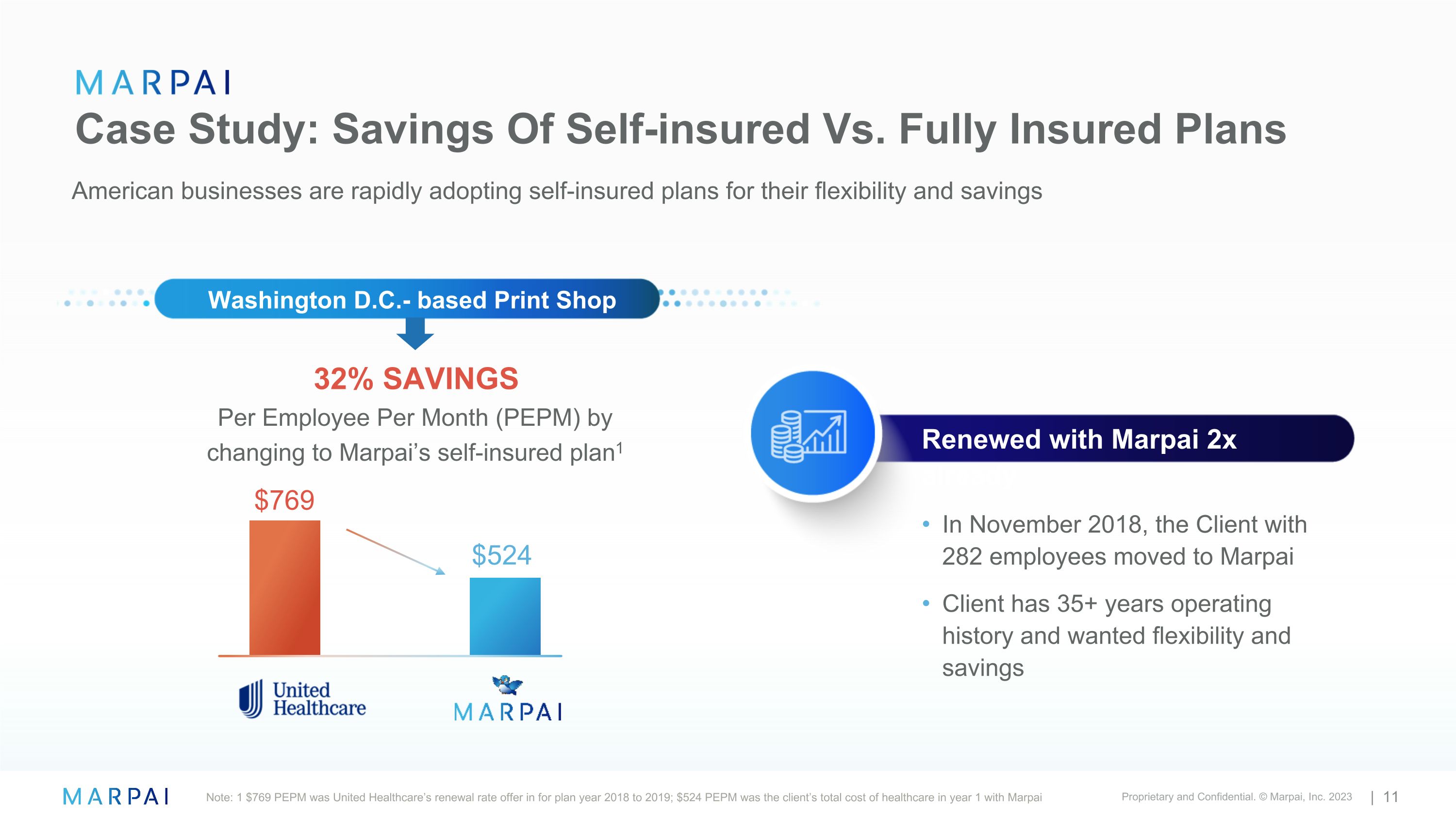

32% SAVINGS Per Employee Per Month (PEPM) by changing to Marpai’s self-insured plan1 Case Study: Savings Of Self-insured Vs. Fully Insured Plans Note: 1 $769 PEPM was United Healthcare’s renewal rate offer in for plan year 2018 to 2019; $524 PEPM was the client’s total cost of healthcare in year 1 with Marpai American businesses are rapidly adopting self-insured plans for their flexibility and savings Washington D.C.- based Print Shop $769 $524 Renewed with Marpai 2x already In November 2018, the Client with 282 employees moved to Marpai Client has 35+ years operating history and wanted flexibility and savings

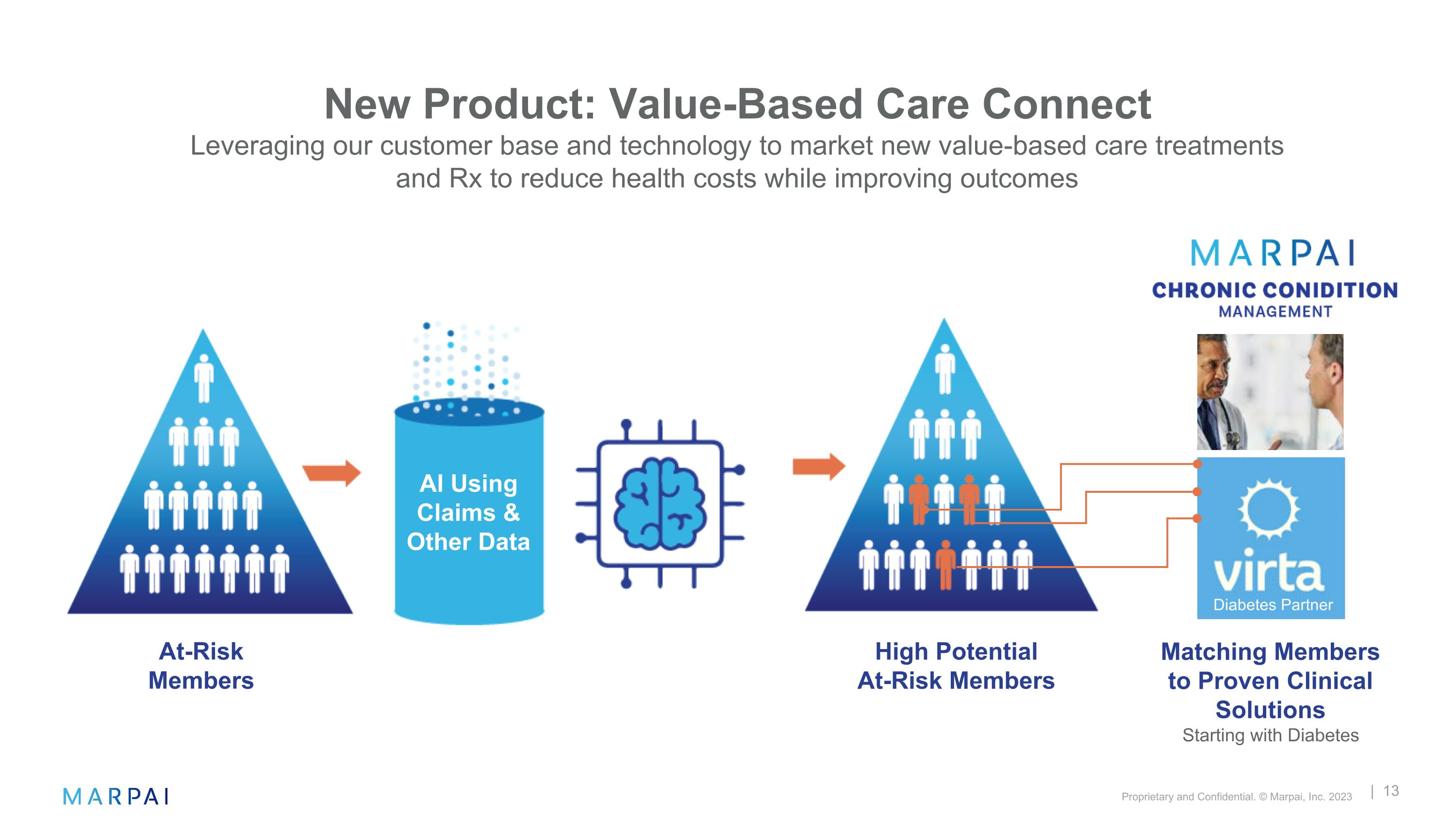

New Product: Value-Based Care Connect Our new product further monetizes our existing member base Marpai VB Care Connect is an aggregator of lives We enable our self-insured customers to work with value-based care (VBC) providers who would not have served our self-insured customers Our VBC partners take on the risk to create value for preventative care Marpai connects the member at the right time to the right VBC provider and participates in shared savings

AI Using Claims & Other Data Matching Members to Proven Clinical Solutions Starting with Diabetes High Potential At-Risk Members At-Risk Members Diabetes Partner New Product: Value-Based Care Connect Leveraging our customer base and technology to market new value-based care treatments and Rx to reduce health costs while improving outcomes

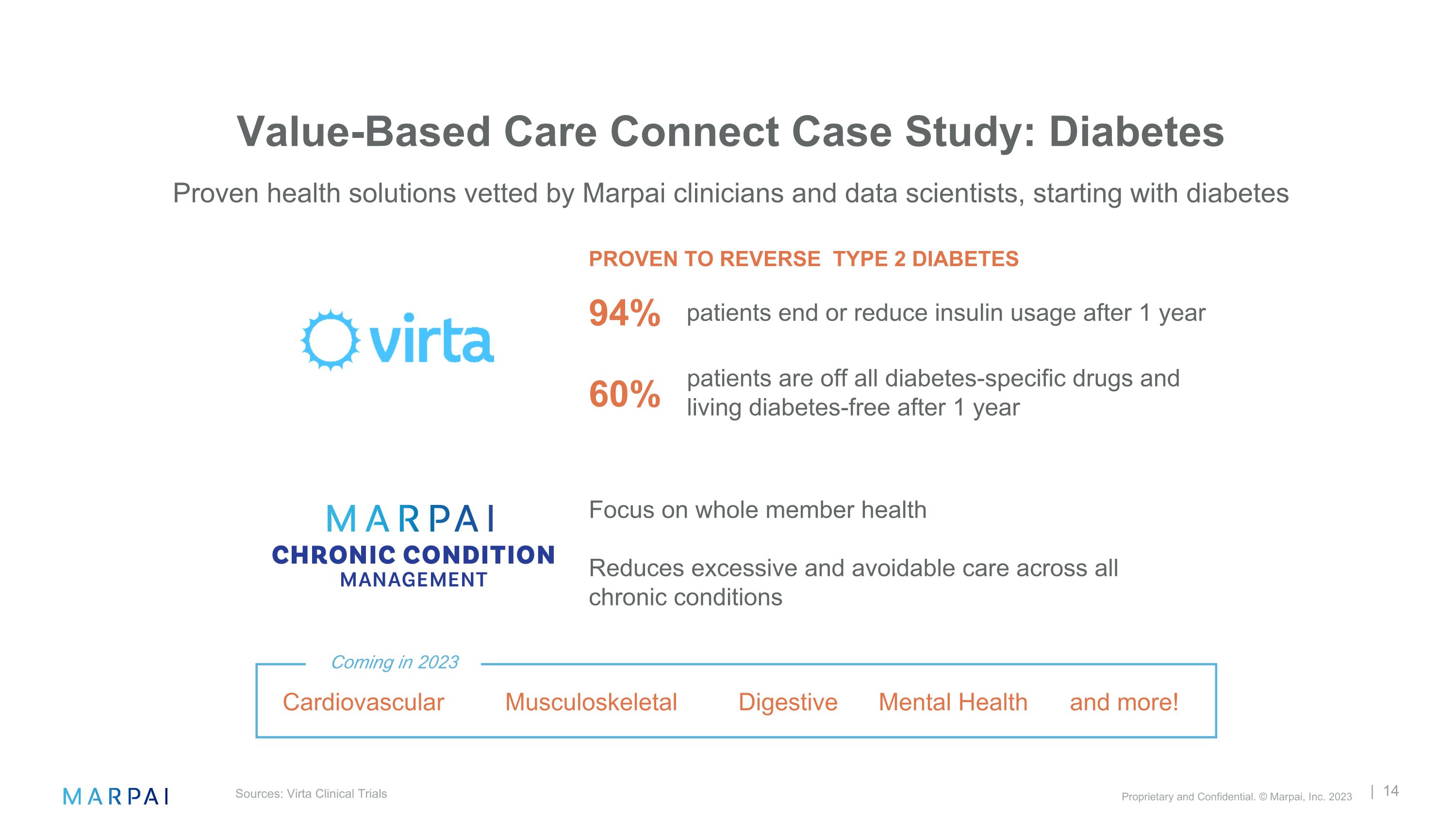

94% 60% PROVEN TO REVERSE TYPE 2 DIABETES patients are off all diabetes-specific drugs and living diabetes-free after 1 year patients end or reduce insulin usage after 1 year Focus on whole member health Reduces excessive and avoidable care across all chronic conditions Coming in 2023 Cardiovascular Musculoskeletal Digestive Mental Health and more! Sources: Virta Clinical Trials Value-Based Care Connect Case Study: Diabetes Proven health solutions vetted by Marpai clinicians and data scientists, starting with diabetes

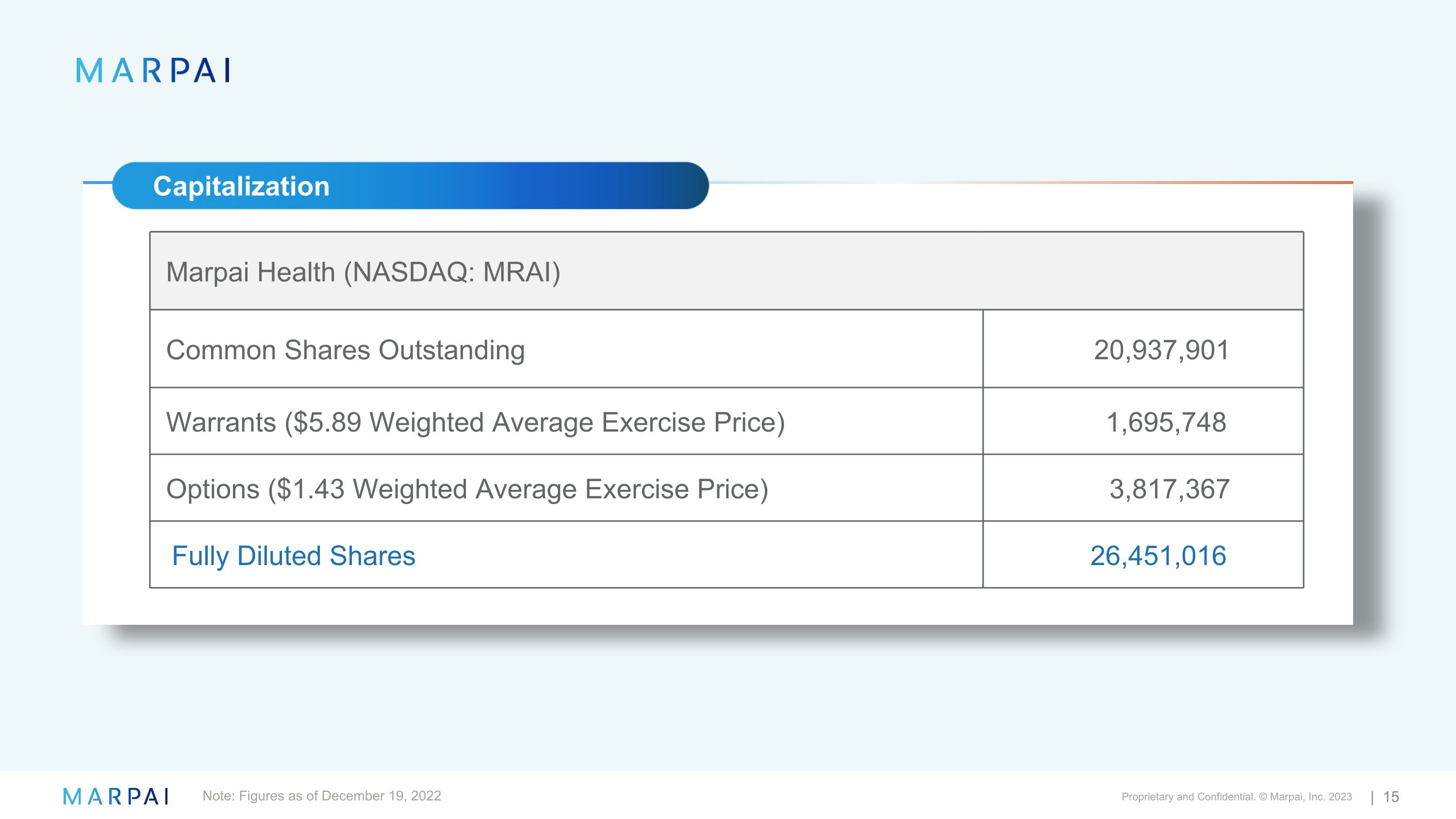

Marpai Health (NASDAQ: MRAI) Common Shares Outstanding 20,937,901 Warrants ($5.89 Weighted Average Exercise Price) 1,695,748 Options ($1.43 Weighted Average Exercise Price) 3,817,367 Fully Diluted Shares 26,451,016 Note: Figures as of December 19, 2022 Capitalization

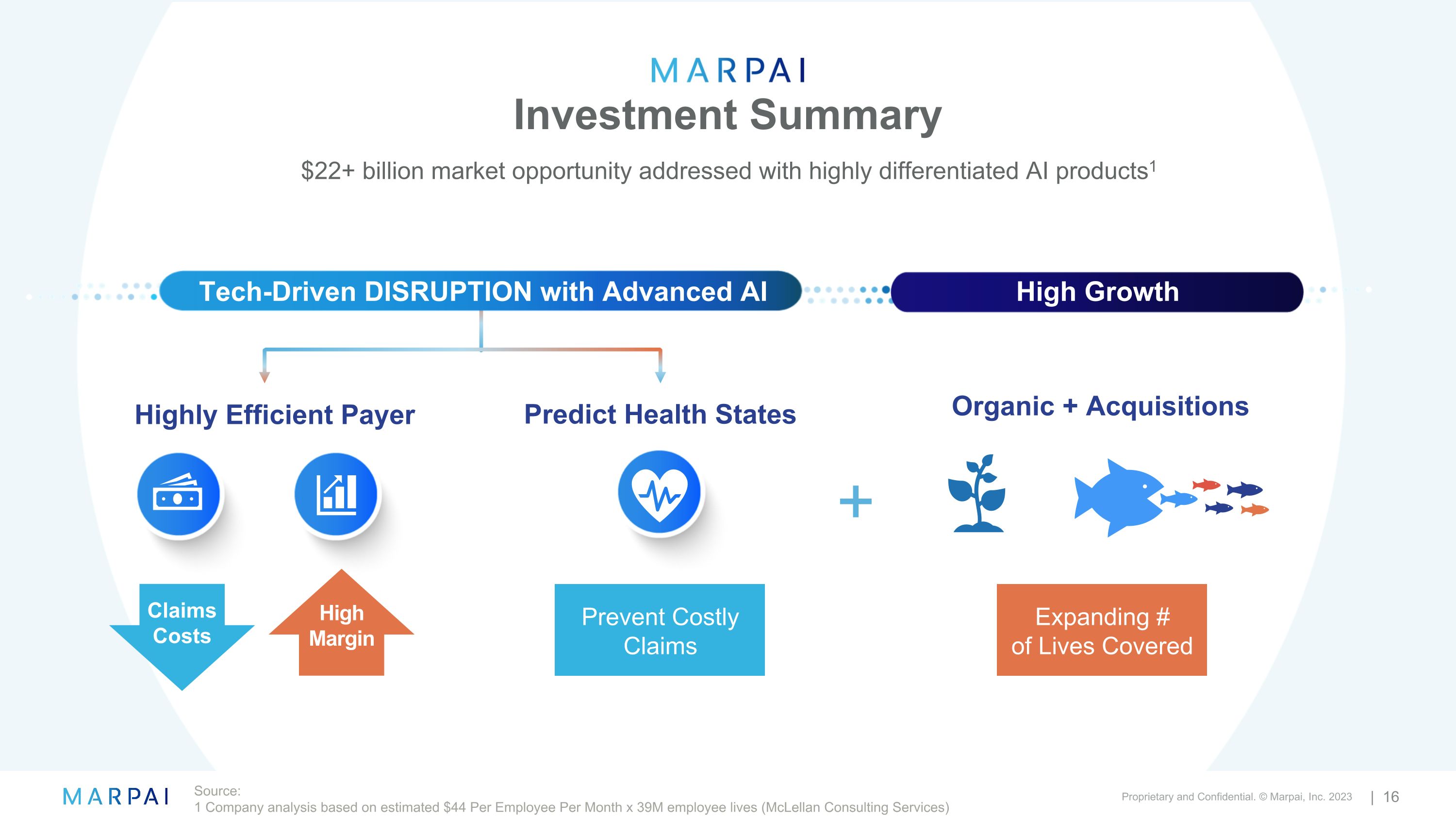

Predict Health States Prevent Costly Claims Organic + Acquisitions High Margin Claims Costs Highly Efficient Payer Investment Summary $22+ billion market opportunity addressed with highly differentiated AI products1 Source: 1 Company analysis based on estimated $44 Per Employee Per Month x 39M employee lives (McLellan Consulting Services) + Tech-Driven DISRUPTION with Advanced AI High Growth Expanding # of Lives Covered

Seasoned Leadership Team Edmundo Gonzalez CEO Lutz Finger President, Product & Development Yoram Bibring CFO Yaron Eitan Chairman Damien Lamendola Director Mohsen Moazami Director Colleen DiClaudio Director Vincent Kane Director Yaron Eitan Chairman Edmundo Gonzalez CEO Seasoned Leadership Team Board of Directors Gonen Antebi COO Sagiv Shiv Director