EXH99.1

EXH99.1

EXH99.1

EXH99.1

FOR IMMEDIATE RELEASE

MARPAI reports FIRST QUARTER 2024 financial results

Reduces Operating Expense by over $5 million and Net Loss by over 50% compared to 2023

Tampa, May 9, 2024, Marpai, Inc. (“Marpai” or the “Company”) (Nasdaq: MRAI), an independent national Third-Party Administration (TPA) company transforming the $22 billion TPA market supporting self-funded employer health plans with affordable, intelligent, healthcare, today announced financial results for the first quarter of 2024. The Company expects to hold a webcast to discuss the results on May 10, 2024.

Q1 2024 Financial Highlights:

“The market is evolving, and we're adapting our approach to better serve our clients' needs. While we saw some client turnover in the first quarter, we are confident that our new initiatives will lead to long-term revenue growth and profitability,” said Damien Lamendola, Chief Executive Officer of Marpai. “We are very pleased to have added a new “off cycle” client in Q1 and the expansion of our sales team with two highly successful industry executives.”

John Powers, Marpai President commented, “Marpai is delivering on its promise to save! Our focus on operational efficiency has significantly reduced operating expenses. Building on this success, as previously announced, we implemented an additional cost-reduction program expected to generate $3 million in annual savings. Marpai remains dedicated to its core mission: reducing client costs and improving member care through continuous operational and financial improvements.”

Webcast and Conference Call Information

Marpai expects to host a conference call and webcast on Friday, May 10, 2024, at 8:30 a.m. ET to answer questions about the Company's operational and financial highlights for its first quarter ended March 31, 2024.

EXH99.1

EXH99.1

Investors interested in listening to the conference call may do so by dialing (800)-836-8184 for domestic callers or +1-646-357-8785 for international callers, or via webcast: https://app.webinar.net/MVqDW74kNpl

About Marpai, Inc.

Marpai, Inc. (Nasdaq: MRAI) is a leading, national TPA company bringing value-oriented health plan services to employers that directly pay for employee health benefits. Primarily competing in the $22 billion TPA sector serving self-funded employer health plans representing over $1 trillion in annual claims. Through its Marpai Saves initiative, the Company works to deliver the healthiest member population for the health plan budget. Operating nationwide, Marpai offers access to leading provider networks including Aetna and Cigna and all TPA services. For more information, visit www.marpaihealth.com, the content of which is not incorporated by reference into this press release. Investors are invited to visit https://www.ir.marpaihealth.com. Investor Relations contact:

Steve Johnson steve.johnson@marpaihealth.com

Forward-Looking Statement Disclaimer

This press release contains forward-looking statements, as that term is defined in the Private Litigation Reform Act of 1995, that involve significant risks and uncertainties. Forward-looking statements can be identified through the use of words such as "anticipates," "expects," "intends," "plans," "believes," "seeks," "estimates," “guidance,” "may," "can," "could", "will", "potential", "should," "goal" and variations of these words or similar expressions. For example, the Company is using forward looking statements when it discusses that it is confident that its new initiatives will lead to long-term revenue growth and profitability and that its additional cost-reduction program is expected to generate $3 million in annual savings. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect Marpai's current expectations and speak only as of the date of this release. Actual results may differ materially from Marpai's current expectations depending upon a number of factors. These factors include, among others, adverse changes in general economic and market conditions, competitive factors including but not limited to pricing pressures and new product introductions, uncertainty of customer acceptance of new product offerings and market changes, risks associated with managing the growth of the business. Except as required by law, Marpai does not undertake any responsibility to revise or update any forward-looking statements whether as a result of new information, future events or otherwise.

More detailed information about Marpai and the risk factors that may affect the realization of forward-looking statements is set forth in Marpai's filings with the Securities and Exchange Commission. Investors and security holders are urged to read these documents free of charge on the SEC's web site at http://www.sec.gov.

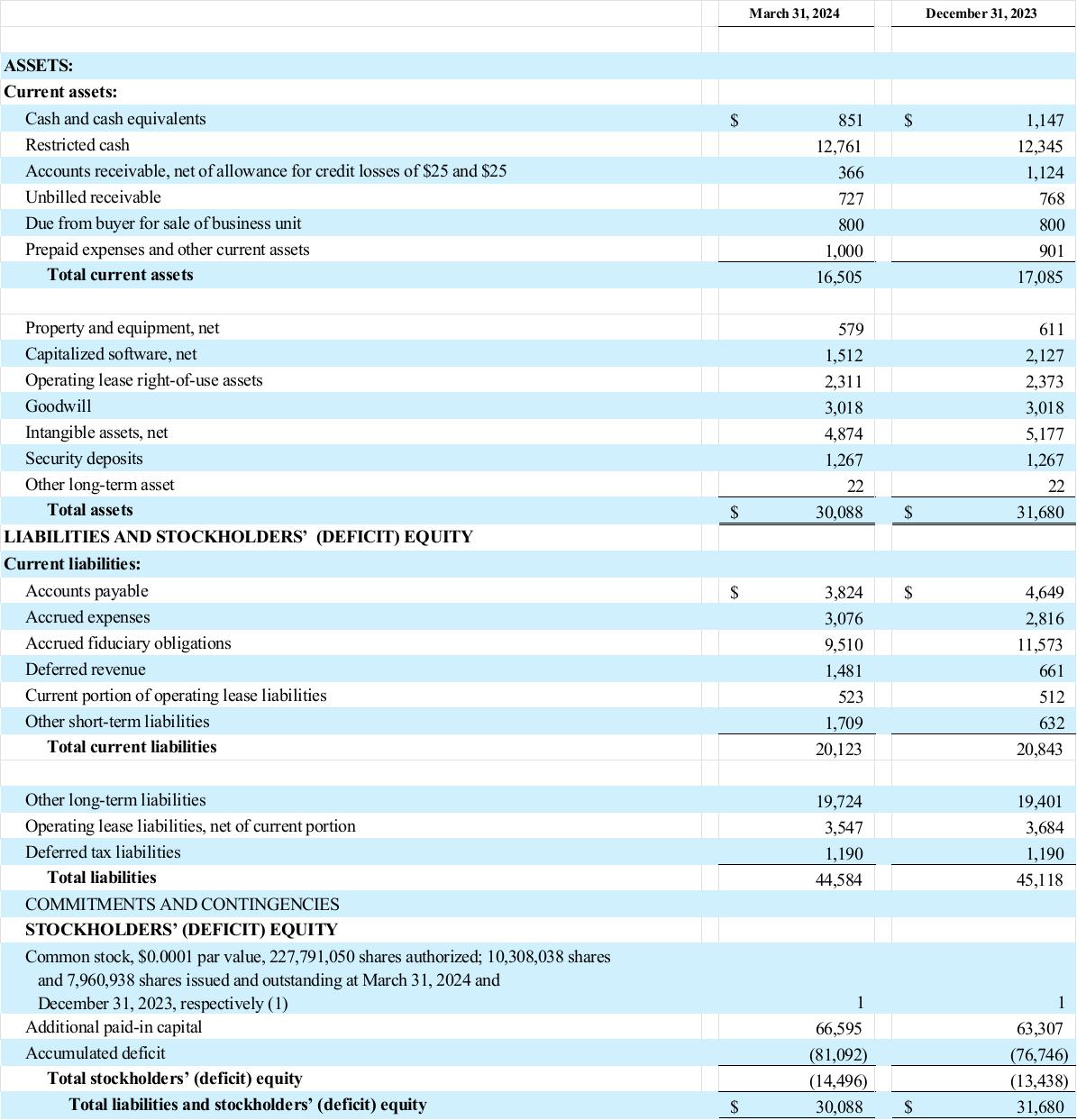

MARPAI, INC. AND SUBSIDIARIES

EXH99.1

EXH99.1

CONDENSED CONSOLIDATED BALANCE SHEET

(in thousands, except share and per share data)

(Unaudited)

(1) Reflects 1-for-4 reverse stock split that became effective June 29, 2023. See Note 1 to the unaudited condensed consolidated financial statements.

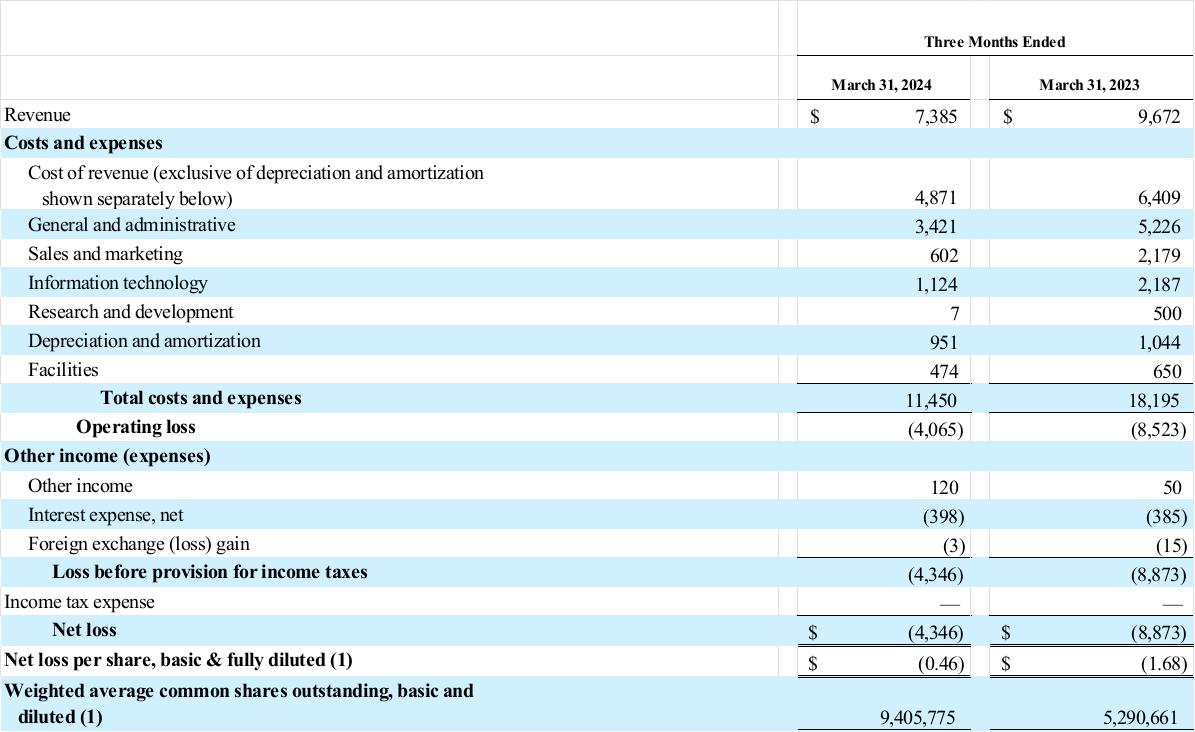

MARPAI, INC. AND SUBSIDIARIES

EXH99.1

EXH99.1

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(in thousands, except share and per share data)

(Unaudited)

(1) Reflects 1-for-4 reverse stock split that became effective June 29, 2023. See Note 1 to the unaudited condensed consolidated financial statements.

EXH99.1

EXH99.1

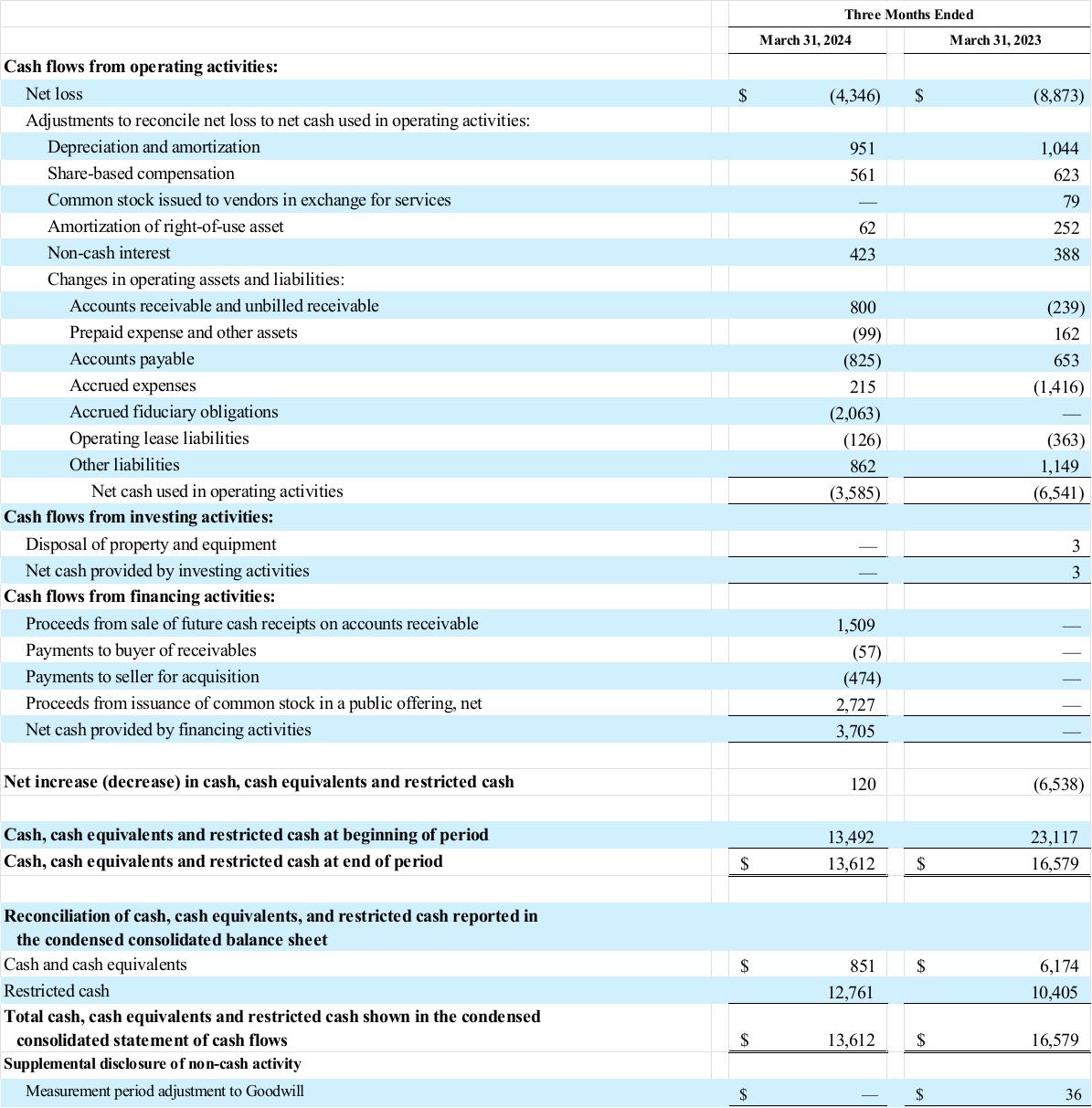

MARPAI, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands, except share and per share data)

(Unaudited)